The infoshot to help kick-start your week

Last Week

- British retailers reported the strongest pre-Christmas demand since 2015 this month but also the biggest price rises since 1990, as fears of shortages led shoppers to buy gifts early, figures from the Confederation of British Industry showed.

- The European Union will propose a nine-month time limit on COVID-19 vaccine validity for travel into the bloc and will also suggest prioritising vaccinated travellers.

- Crude futures are steady as investors digested the news that the U.S will release 50 million barrels from its strategic reserves – an unprecedented, coordination attempted by the world’s largest oil consumers to tame prices that could prompt a backlash by OPEC+.

- Sweden’s first female prime minister, Magdalena Andersson, was forced to resign only hours after her historic appointment. The resignation was triggered after the Green Party quit their two-party coalition, causing political uncertainty.

- Olaf Scholz replaces outgoing German chancellor Angela Merkel as a new coalition is announced.

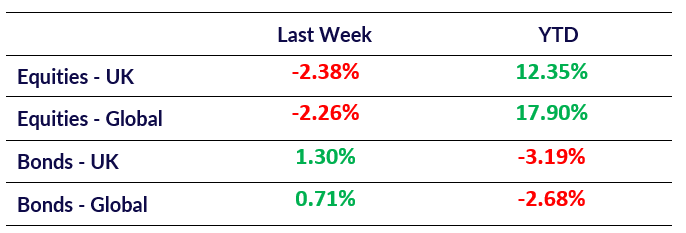

Market Pulse

Coming Up

- German CPI YoY to be released on November 29th, forecasted to be 4.4%.

- Eurozone CPI YoY to be released on November 30th, forecasted to be 4.4%.

Notice:

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.Open document settingsOpen publish panel