The infoshot to help kick-start your week

Last Week

The Bank of England raised interest rates to 5% through a surprise 0.5% increase as it aims to take control of persistent inflation. This 0.5% rate increase came as a surprise to the market which was widely expecting the BoE to follow the ECB’s recent 0.25% jump. Seven out of the nine Monetary Policy Committee members voted for the increase on the back of recent high inflation and weaker labour market figures. Raising rates to this new level has already taken interest rates over the forecasted peak from the BoE made back in May.

UK banks have agreed to give borrowers who fall behind on mortgage payments a 12-month grace period before repossessing homes. This agreement has been made after fears that the recent BoE rate rise will lead to unaffordable jumps in monthly mortgage payments for borrowers on variable rates which threatens the stability of the mortgage and housing market. With the UK market now expecting interest rates to peak at 6.25 per cent, the mortgage market is only going to be put under more pressure.

The shares of UK banks fell late last week as recession concerns grew once again and the gains from rising interest rates seem come to an end for the banking industry. The fall in bank shares highlights the market’s concern over the credit quality of the debt issued by these institutions. Potential defaults coming over the next few months has been priced into the market while banks, such as Lloyds’, have been stressing the quality of their mortgage and loan books.

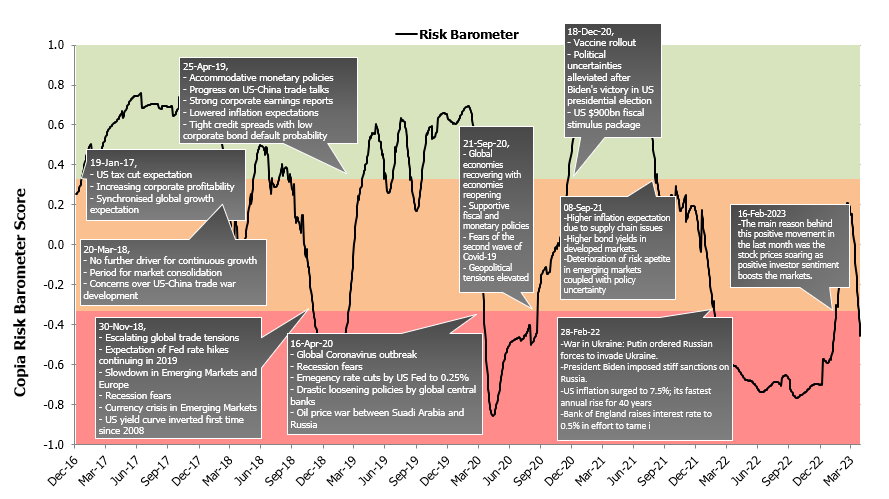

Market Pulse

Coming Up

- US Initial Jobless Claims released June 29th, 1:30 pm.

- EU June CPI data released June 30th, 10:00 am.

Notice:

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.Open document settingsOpen publish panel