The infoshot to help kick-start your week

Last Week

- The S&P 500 closed at record highs Thursday, as gains in big tech and a Tesla-fuelled climb in consumer discretionary sparked an intraday turnaround on Wall Street. The S&P 500 rose 0.3% to close at a record high of 4,549.78 eclipsing the previous record of 4,536.95, the Dow Jones Industrial Average slipped 0.02%, or 6 points, and the Nasdaq Composite added 0.6%.

- Oil tumbled on Thursday as a forecast for a warm U.S. winter put the brakes on a rally that drove prices to a three-year high above $86 a barrel early in the session on tight supply and a global energy crunch.

- China Evergrande Group has supplied funds to pay interest on a U.S. dollar bond, days before a deadline that would have seen the developer plunge into formal default.

- The Bank of England’s new chief economist has warned that UK inflation is likely to hit or surpass 5% by early next year.

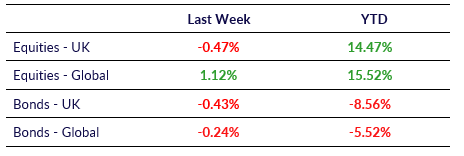

Market Pulse

Coming Up

- Germany unemployment rate to be released on October 28th, forecasted to be 5.4%.

- Japan unemployment rate to be released on October 28th, forecasted to be 2.8%.

Please check out our latest monthly and quarterly performance updates on our website.

Notice:

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.Open document settingsOpen publish panel