The infoshot to help kick-start your week

Last Week

- ECB raised rates by 50 basis points, its first hike since 2011. The ‘jumbo’ hike is synonymous with large hikes elsewhere, leading to fears that central banks will over-reach in the battle against inflation, increasing the risk of recession.

- UK inflation continues to rise; the data was released at 9.4%, up from 9.1% in May.

- China’s holdings of US debt drop below $1 trillion for the first time in 12 years, as China looked to diversify its foreign reserves ahead of Fed rate hikes.

- Russia drops interest rates by 150 bps – larger than expected, as it battles with a strong currency, cooling inflation and a possible recession on the horizon.

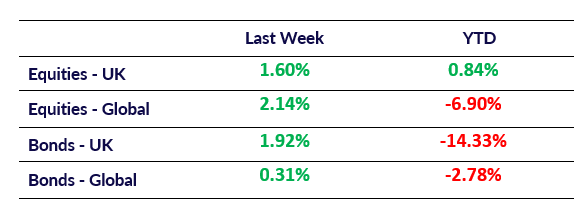

Market Pulse

Coming Up

- Fed Interest rate decision released 27th July, predicted to raise by further 75 basis points.

- US GDP (Q2 QoQ) data released 28th July, forecasted to be 0.4%, increased from -1.6%.

- EU CPI (Jul YoY) data released 29th July, predicted to increase from 8.6% to 8.7%.

Notice:

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.Open document settingsOpen publish panel