The infoshot to help kick-start your week

Last Week

China’s economy grew faster than expected in the first three months of the year, as the country emerged from tough lockdown restrictions. Compared to Q1 2022, GDP grew by 4.5% according to key data. Growth was driven largely by a boost in household spending and rising factory activity. Investors have been awaiting the data for clues on the strength of China’s recovery, although whether this trend will sustain for the remainder of 2023 remains to be seen.

Supermarkets say price rises will ease soon, which comes as good news to many who are feeling the pressure of the cost-of-living crisis. Inflation was expected to fall below 10% last month but soaring prices meant it fell by less than expected. A drop in the cost of wholesale food prices globally has not yet led to similar falls in the prices charged by UK supermarkets. There is typically a three to nine month lag to see price falls reflected in shops, and given that food production costs peaked in October 2022, the British Retail Consortium expects food prices to come down over the next couple of months.

Longview Economics’ Chris Watling said Friday that a recession is coming, echoing the sentiment of investors who continued to evaluate the likelihood of a greater-than-expected economic slowdown. The deliberation follows Philadelphia Fed manufacturing index data from earlier in the week, which showed a much greater contraction than forecasted. The view contrasts that of the IMF, which recently revised its prediction for U.S economic growth, from 1% in late 2022 to 1.6% in the most recent report earlier this month.

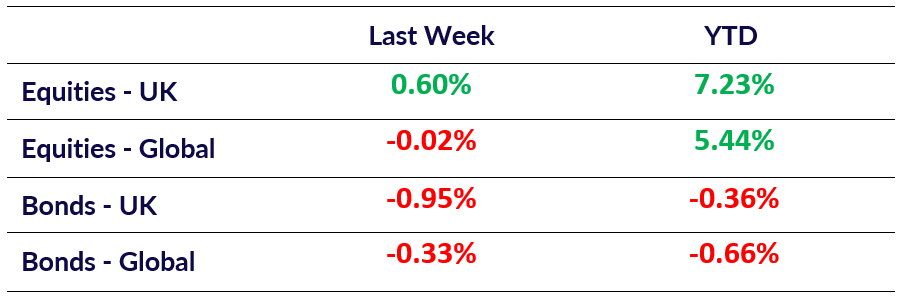

Market Pulse

Coming Up

- US GDP (Q1 QoQ) data released April 27th, 1:30 pm.

- US Initial Jobless Claims data released April 27th, 1:30 pm.

Notice:

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.Open document settingsOpen publish panel