The infoshot to help kick-start your week

Last Week

- Turkey has paused its aggressive cycle of interest rate cuts amid soaring inflation that threatens to pass 40 per cent in the months ahead.

- Shares of Netflix have fallen over 20% to under $400. Erasing about $45 billion in market value as investors concluded that the streaming giant is entering a new phase of slower growth.

- On Thursday, the Nasdaq index ended the day down 1.3 per cent. It has now fallen 12.7 per cent from a its record in November.

- Russia wants NATO to remove all its forces from Bulgaria, Romania and other ex-communist states in eastern Europe that joined the alliance after 1997, the foreign ministry said on Friday. This underlines Moscow’s hard-line position ahead of security talks with the US in Geneva.

- The volume of monthly retail sales in Great Britain fell 3.7 per cent between November and December, according to data from the Office for National Statistics.

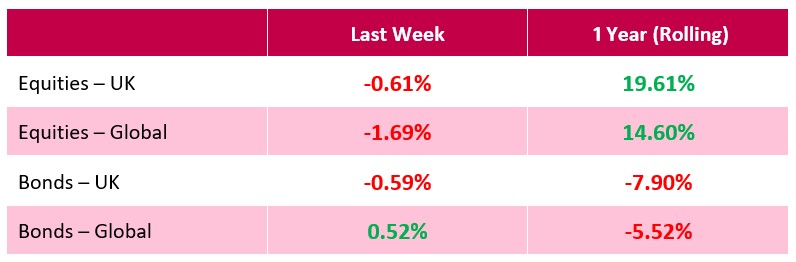

Market Pulse

Coming Up

- US Fed funds target rate to be announced on January 26th

- Apple to release its fiscal first-quarter earnings on January 27th, expected to be $1.68 per share.

Notice:

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.Open document settingsOpen publish panel