The infoshot to help kick-start your week

Last Week

Japan’s TOPIX Index hit its highest point since 1990 last week, a sign that foreign investors are returning to the region. The index has gained more than 6% year-to-date outperforming its regional peers in the Asia-Pacific. The index is made up of around 2000 constituents, and its recent push was led by a combination of utilities, consumer cyclicals, technology, and financials. Analysis by Société Générale indicates that foreign investors bought a net $15.4 bn worth of Japanese stocks in April.

The UK is currently lobbying the EU over a Brexit trade deal deadline that carmakers have warned pose a real threat to the UK automobile industry. Stellantis, which owns Vauxhall and Peugeot, among others, has warned that its UK factories are at risk due to a possible tariff of 10% on exports to the EU due to new rules based on where parts are sourced from. The European Automobile Manufacturers’ Association has also asked the EU to extend the deadline, arguing that the supply chain is not ready given recent surges in raw material costs.

Talks in the US continue regarding raising of the government’s $31.4 trillion debt ceiling, which was already breached in January of this year. While leaders on both sides of the political aisle appear to be closer to reaching an agreement, the situation hangs delicately in the balance. In a recent letter to Congress, Treasury Secretary Yellen confirmed that her department would be able to pay the U.S. Government’s bills until June 1 before a risk of default.

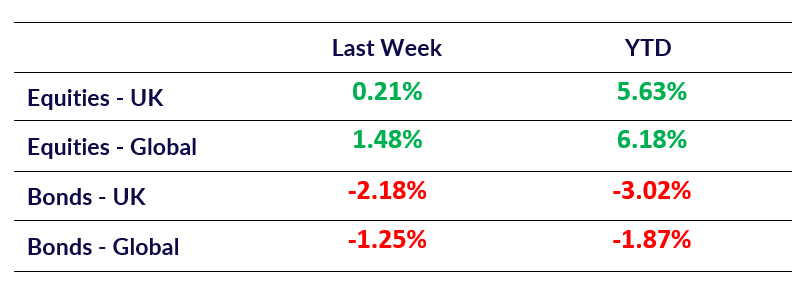

Market Pulse

Coming Up

- UK CPI (YoY Apr) data released May 24th, 7:00 am.

- US Initial Jobless Claims data released May 25th, 1:30 pm.

Notice:

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.Open document settingsOpen publish panel