The infoshot to help kick-start your week

Last Week

- US stock market indices took a hit on Thursday morning after data showed that US economic growth was less than expected in the first quarter. Gross domestic product increased to an annualised rate of 1.6% which was lower than the 2.4% figure expected by economists. The S&P 500 dropped 1.5% in the early hours of trading before finishing down 0.5% while the Dow Jones Index closed 1% lower on the day.

- The US personal consumption expenditure (PCE) price index increased 2.8% year-on-year in March when food and energy prices were excluded. The index, which is the Fed’s preferred inflation metric, came in higher than the 2.6% expected by economists in another hit to hopes that the Federal reserve will cut by the end of the summer.

- The Yen tumbled to a new 34 year high after the Bank of Japan held interest rates steady on Friday. The Yen traded as low as ¥157.78 against the dollar on Friday before breaking the ¥160 on the early hours of Monday morning. Despite a rate cut not being expected by economists, traders have been concerned with the lack of Bank of Japan response to the Yen’s weakness.

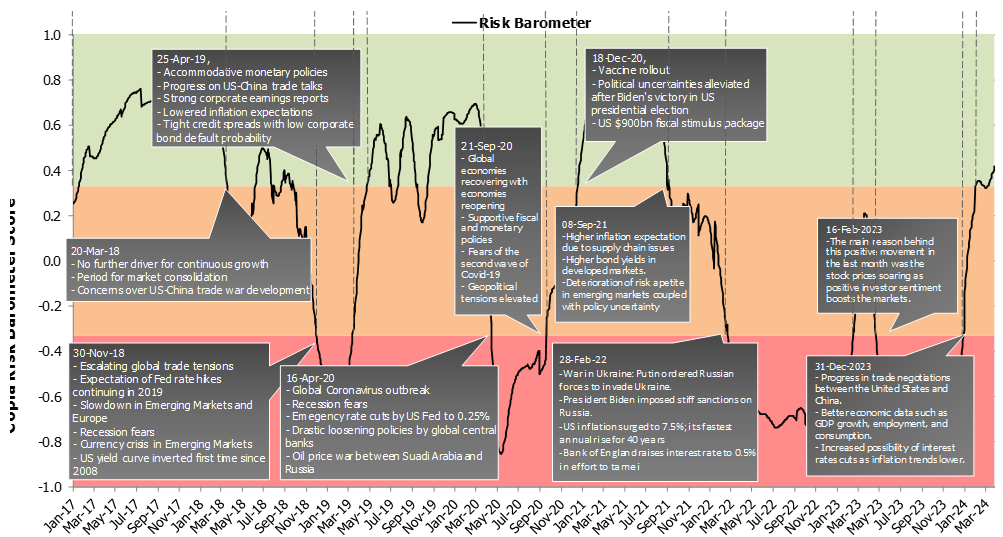

Market Pulse

Coming Up

- EU April CPI data released, Tuesday 30th April 2024 at 10:00am.

- US Unemployment data released, Friday 3rd May 2024 at 1:30pm.

Notice:

For professional advisers only, Copia does not provide financial advice, and the contents of this document should not be taken as such. The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.Open document settingsOpen publish panel