The infoshot to help kick-start your week

Last Week

- UK inflation slowed less than expected in March to an annual rate of 3.2 per cent. The figure was slightly higher than the 3.1 per cent forecasted by economists and led the markets to push back its Bank of England rate cutting expectations to either September or November. After the announcement, markets priced in 0.38 percentage points in cuts by the end of the year which was slightly down from 0.42 percentage points seen before the data was released.

- China’s gross domestic product rose 5.3 per cent in first quarter year-on-year. The data came in higher than the 4.6 per cent forecasted by economists polled by Reuters and sat higher than the 5.2 per cent seen in the final quarter of 2023. Industrial production growth of 6.1 per cent in the first quarter helped to push the overall figure higher as high-tech manufacturing such as electric vehicles and electrical components all increased in output.

- The IMF warned the US that its considerable fiscal deficits pose ‘significant risks’ for the global economy. The IMF noted that it expected the US to have a 7.1 per cent fiscal deficit next year which was much higher than the averages of other developed economies which sat just below 2 per cent. The IMF also noted concern over China’s fiscal deficit which is forecasted to sit at 7.6 per cent in 2025.

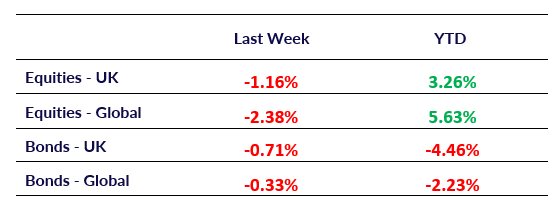

Market Pulse

Coming Up

- UK PMI data released, Tuesday 23rd April at 9:30am.

- US PMI data released, Tuesday 23rd April at 2:45pm.

- Bank of Japan interest rate decision, Friday 26th April at 4:00am.

Notice:

For professional advisers only, Copia does not provide financial advice, and the contents of this document should not be taken as such. The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.Open document settingsOpen publish panel