The infoshot to help kick-start your week

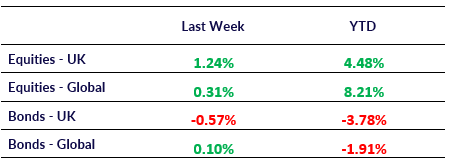

Last Week

- US inflation came in higher than expected, rising 3.5 per cent year on year in March. Bond and stock prices fell on the back of the news and the market pushed back on its summer rate cut forecast as inflation continues to prove stickier than previously expected. Futures traders are now pricing in between one and two quarter-point cuts this year in the US, down from the six cuts expected in January.

- The dollar had its strongest weekly performance since September 2022 as the currency rose 1.7 per cent against an average of six major currencies. The jump up in bonds yields, which trade inversely to bond prices, that was stimulated by high inflation data helped push the dollar higher. The Euro and sterling fell to their weakest level against the dollar since November on Friday.

- The UK economy grew by 0.1% in February thanks to an expansion in manufacturing as hopes rise that the UK is emerging from a technical recession. The rise in growth in February increases the likelihood that the UK economy expanded in the first quarter on 2024 which could mark the end of the technical recession seen at the end of 2023 which saw the UK experience two consecutive quarters of negative growth.

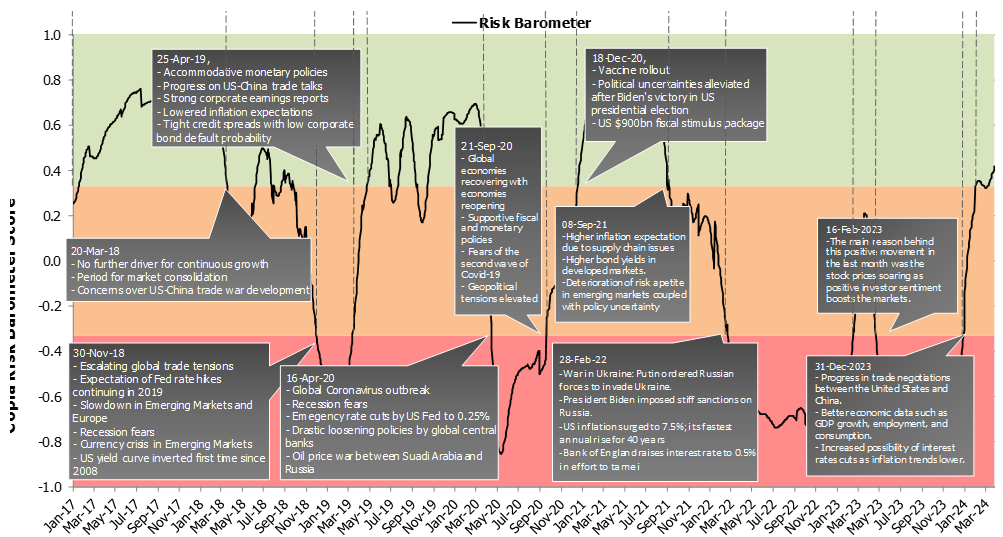

Market Pulse

Coming Up

- UK March CPI data released, Wednesday 17th April 2024 at 7:00am.

- EU March CPI data released, Wednesday 17th April 2024 at 10:00am.

- US Initial Jobless Claims data released, Thursday 18th April 2024 at 1:30pm.

Notice:

For professional advisers only, Copia does not provide financial advice, and the contents of this document should not be taken as such. The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.Open document settingsOpen publish panel