The infoshot to help kick-start your week

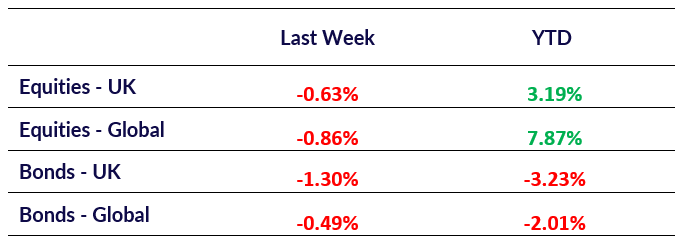

Last Week

- Eurozone inflation fell below expectations to 2.4 per cent in March. Inflation fell from the 2.6 per cent reported in the previous month and helped bolster expectations that the European Central Bank will cut interest rates by the summer with most analysts expecting policymakers to cut rates in June. Despite the fall in inflation, rapid-wage growth is keeping costs high in the services sector where the annual inflation remains at 4 per cent.

- Data showed that US employers added 303,000 jobs in March in a further sign of a strong labour market. Friday’s figures were much stronger than the 200,000 jobs that were anticipated by economist and were above the January and February figures. The stronger-than-expected labour market figures led traders to reassess the likelihood of a Fed rate cut by the Summer, with future markets indication an approximate 50 per cent chance of a first rate cut in June.

- UK house prices fell in March for the first time in six months according to data from Halifax. The average house price fell 1 per cent month on month in March, and for the first time in six months, to £288,430 from £291,338. Halifax noted that affordability constraints have led to a drag down on prices despite showing surprising signs of resilience in the last few months.

Market Pulse

Coming Up

- US March CPI data released, Wednesday 10th April at 1:30pm.

- EU ECB Interest Rate decision, Thursday 11th April at 1:15pm.

Notice:

For professional advisers only, Copia does not provide financial advice, and the contents of this document should not be taken as such. The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.Open document settingsOpen publish panel