The infoshot to help kick-start your week

Last Week

- UK shop price inflation in March fell below 2 per cent for the first time in more than two years. Data from the British Retail Consortium showed shop price inflation had fallen to 1.3 per cent in March down from 2.5 per cent in February. The inflation for both food and non-food prices have consistently fallen over the last few months in a sign that a surge in food prices is coming to an end.

- US small-cap stocks are enduring their weakest run relative to large-cap stocks in more than 20 years. The Russel 2000 index, a widely used small-cap index, has risen 24 per cent since the beginning of 2020 and has lagged the S&P 500’s growth of approximately 62%. Small-caps have historically delivered higher returns over longer periods with investors rewarded for higher volatility. However, with small-cap stocks heavily impacted by high inflation and with the S&P 500 benefitting from huge gains from the likes of Nvidia and Meta, the relative performance has been weak.

- The Japanese Yen reached a 34-year low against the US Dollar on Wednesday with authorities in Tokyo not ruling out intervention if the currency falls further. The Yen dropped to ¥151.94 against the Dollar despite the country’s recent move away from ultra-loose monetary policy and negative interest rates. The Yen has since improved slightly from its Wednesday’s lows and has not breached the ¥152 level.

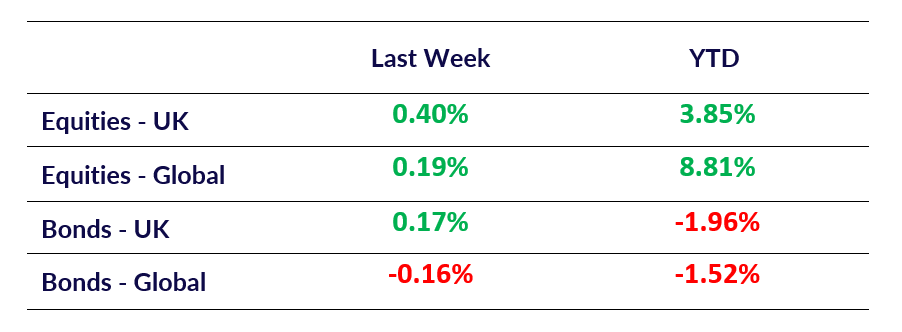

Market Pulse

Coming Up

- EU March CPI data released, Wednesday 3rd April 2024 at 10:00am.

- US March unemployment rate data released, Friday 5th April 2024 at 1:30pm.

Notice:

For professional advisers only, Copia does not provide financial advice, and the contents of this document should not be taken as such. The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.Open document settingsOpen publish panel