The infoshot to help kick-start your week

Last Week

- The Bank of Japan raised interest rates for the first time since 2007 as the country moves away from years of deflation. Kazuo Ueda, the Bank of Japan government brought the interest rate up to sit in a range of 0 to 0.1 per cent from -0.1 per cent. Japan brought in negative interest rates in 2016 in the hope to stimulate spending and lending and has become the last central bank to end the use of negative interest rates.

- UK inflation fell to its lowest rate since 2021 as it dropped more than forecasted to 3.4 per cent. The rise in consumer prices seen in the year to February was below the 3.5 per cent forecasted by economists and lower than the 4 per cent figure seen in January. Later in the week, the Bank of England held rates at 5.25 per cent with the Governor Andrew Bailey noting that things were moving in the right direction.

- The Federal Reserve unanimously voted to leave rates unchanged at 5.25-5.5 per cent but Fed officials signalled that they still expect interest rates to be cut by 0.75 per cent in 2024. The Federal Reserve released a dot-plot chart that showed most officials believed rates would sit at 4.5-4.75 at the end of the year. The S&P 500 closed 0.9 per higher to a new record on the back of this news. While the two-year Treasury yield, which moves inversely to prices, fell 0.02 per cent.

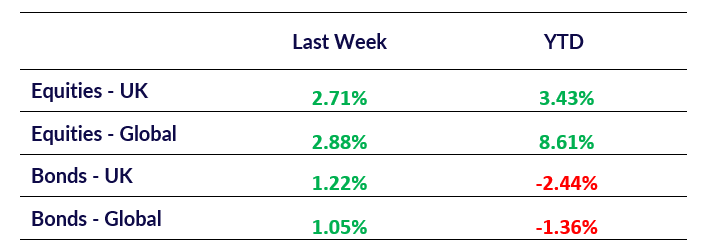

Market Pulse

Coming Up

- UK Q4 GDP data released, Thursday 28th March at 7:00am.

- US Q4 GDP data released, Thursday 28th March at 12:30pm.

Notice:

For professional advisers only, Copia does not provide financial advice, and the contents of this document should not be taken as such. The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.Open document settingsOpen publish panel