The infoshot to help kick-start your week

Last Week

- US inflation unexpectedly rose to 3.2 per cent in February with the Federal reserve facing a small pushback on its fight against inflation. Economists had expected annual inflation to remain at January’s 3.1 per cent, but the figure crept slightly high as a result of higher prices from services such as vehicle insurance and transportation services.

- The UK economy returned to growth in January with the Office for National Statistics announcing on Wednesday that GDP rose 0.2 per cent between December and January. The economy was pushed higher by services and construction. The rise in GDP follows a technical recession at the end of last year after the UK experienced two consecutive quarters of economic contraction.

- Oil prices rose to a four-month high on Thursday after the International Energy Agency said that the oil market would be in a slight deficit this year after reducing its supply growth forecast. The watchdog revised its supply growth forecast from 1.7m barrels a day to 800,000 barrels a day while upgrading its consumption forecast to 1.3m barrels a day. Brent crude rose above $85 a barrel for the first time since November on the back of the revision.

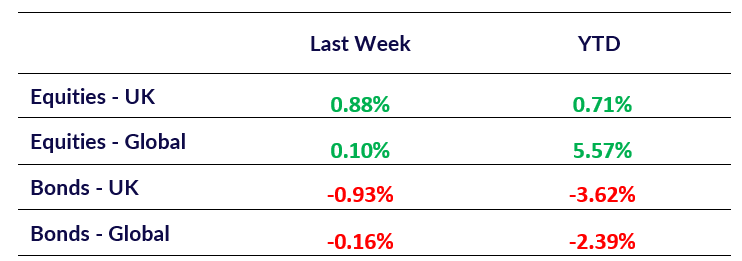

Market Pulse

Coming Up

- US Federal Reserve Interest Rate Decision, Wednesday 20th March at 6:00pm.

- UK PMI data released, Thursday 21st March at 9:30am.

- UK Bank of England Interest Rate Decision, Thursday 21st March at 12:00pm.

Notice:

For professional advisers only, Copia does not provide financial advice, and the contents of this document should not be taken as such. The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.Open document settingsOpen publish panel