The infoshot to help kick-start your week

Last Week

- US inflation pulled down to 2.4 per cent in the 12 months to January which maintained the expectations of rate cuts later in the year. The rate is slightly down from the 2.6 per cent seen in December while the core rate PCE, which excludes volatile food and energy prices, remained in line with expectations at 2.8 per cent. Traders are still pricing in three to four rate cuts this year.

- There has been a surge in the number of companies using convertible bonds to issue cheap debt. In February, roughly $7.8bn was raised by US companies via convertible bonds, making it the higher monthly figure since August. Convertible bonds typically pay lower interest than a regular bond but can later be exchanged for shares if agreed conditions are met. Convertible bond issuance often rises in markets where equity valuations are high as it gives companies the opportunity to raise cheaper capital without the risk of share dilution.

- Bitcoin hit $60,000 on Wednesday for the first time in more than two years and is now sitting above $65,0000, nearing its all-time-high of nearly $69,000. The cryptocurrency has been boosted after US regulators approved the launch of new spot bitcoin ETFs by major asset managers which is opening the door to new influx of cash into the cryptocurrency space.

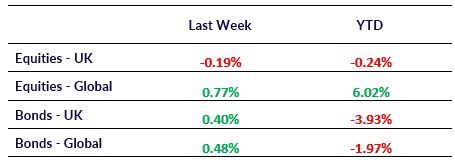

Market Pulse

Coming Up

- UK February PMI data released; 5th March at 9:30am.

- UK Spring Budget, 6th March at 12:30pm.

- ECB Interest Rate Decision, 7th March at 1:15pm.

Notice:

For professional advisers only, Copia does not provide financial advice, and the contents of this document should not be taken as such. The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.Open document settingsOpen publish panel