The infoshot to help kick-start your week

Last Week

- The Nikkei 225 index, Japan’s main stock market index, reached a new all time high as it surpassed its value seen at the end of the 1980s. The Nikkei 225 has been the world’s best performing major index in 2024 and has risen over 17.5 per cent since the turn of the year. The country has been boosted by improved business confidence alongside a weak yen which has pulled foreign investors into Japan and boosted exports.

- European gas prices have fallen to a level that hasn’t been seen since Russia constricted supplies in 2021. The price of TTF, the European natural gas benchmark, fell as low as €53/MWh on Friday which was the lowest seen since May 2021 and a considerable drop from the summer of 2022 peak where prices rose to more than €300/MWh. Recent strong imports of natural gas, warm weather and reduced demand have all helped keep prices down.

- The UK has granted retail investors access to buy newly issued gilts for the first time as the government prepares for a major year in bond sales with the government’s gross financing requirement estimated to be around £277bn for the 2024-2025 financial year. New bond issues are typically limited to institutional investors but are now being opened to private investors as well. The move brings the UK closer in line with other major bond markets which already sell bonds directly to the public.

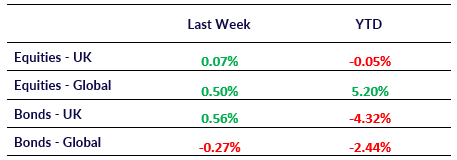

Market Pulse

Coming Up

- UK February Manufacturing PMI data released, Friday 1st March at 9:30am.

- EU February CPI data released, Friday 1st March 2024 at 10:00am.

Notice:

For professional advisers only, Copia does not provide financial advice, and the contents of this document should not be taken as such. The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.Open document settingsOpen publish panel