The infoshot to help kick-start your week

Last Week

- US inflation cooled less than expected in January with it coming it at 3.1 per cent year on year. Despite being lower than the 3.4 per cent figure seen in December, it missed economist expectations of 2.9 per cent. US Treasury yields jumped on the back of Tuesday’s data release with the benchmark 10-year yield rising 0.18 per cent in its biggest daily move since March.

- UK inflation came in below analyst and the BOE’s estimates as it held at 4 per cent for the 12 months ending in January. Despite being the same figure as seen in December, the rate was below the 4.2 per cent analysts expected and the 4.1 estimate by the central bank. Traders are placing 65 per cent probability that there is a rate cut by June which was up from 40 per cent before the data was released.

- Data showed that the UK slipped into a technical recession at the end of last year after seeing two consecutive quarters of negative growth. Gross domestic product fell 0.3 per cent in the final quarter of 2023 which followed a 0.1 per cent decline in the third quarter. The ONS said that manufacturing, construction, and wholesale were the biggest draggers on growth in the final quarter of 2023.

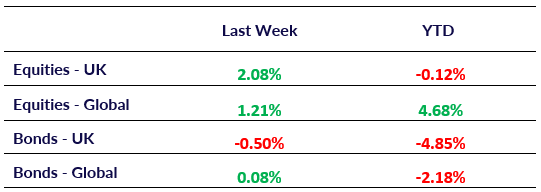

Market Pulse

Coming Up

- UK PMI data released, Thursday 22nd February at 9:30am.

- EU January CPI data released, Thursday 22nd February at 10:00am.

- US January Existing Home Sales data released, Thursday 22nd February at 3:00pm.

Notice:

For professional advisers only, Copia does not provide financial advice, and the contents of this document should not be taken as such. The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.Open document settingsOpen publish panel