The infoshot to help kick-start your week

Last Week

- On Thursday, the European Central Bank rose interest rates by 25 basis points, taking rates back to record highs of 3.75 per cent. This rate was last seen in 2001 when the central bank was first trying to boost its currency. Despite the interest rate rise, the euro dropped 0.5 per cent against the dollar as the central bank suggested that rate raises may be coming to an end.

- US stocks were boosted on Friday after the US personal consumption expenditures index (PCE), the Fed’s preferred measure of inflation, dropped to an annualised rate of 3 per cent in June down from 3.8 per cent in May. This improved hopes that the Fed was approaching its 2 per cent target and that further rate hikes may be limited over the coming months.

- The US also reported stronger than expected second-quarter growth despite rate rises over the last few months. Between April and June, the economy grew 2.4 per cent according to data released on Thursday. This growth rate was higher than the 2 per cent seen in the first quarter and was comfortably above economist expectations of 1.8 per cent.

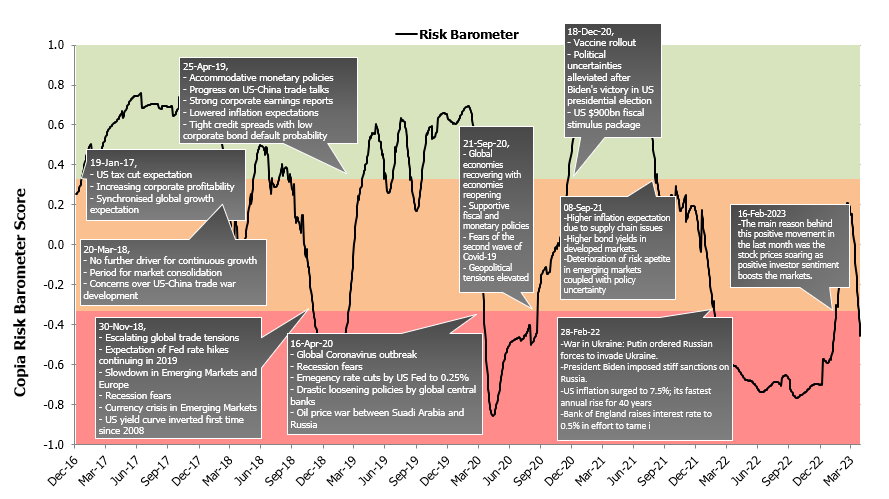

Market Pulse

Coming Up

- BoE Interest Rate Decision, August 3rd, 12:00pm

- US Unemployment Rate, August 4th, 1:30pm

Notice:

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.Open document settingsOpen publish panel