The infoshot to help kick-start your week

Last Week

- US inflation fell to 3 per cent in June, signalling that aggressive rate hikes from the Fed are taking effect. The US has been successful at moving inflation towards the Federal Reserve’s 2% target while the UK grapples with a stubbornly high inflation rate of 8.7%. Core inflation, which ignores energy and food prices, has remained slightly sticker in the US and still sits slightly higher at 4.8%.

- JP Morgan saw net income jump 67% year-on-year in the second quarter allowing the bank to beat analysts’ estimates. This was fuelled by the growing spread between the interest the bank pays on deposits and the interest earnt from loans. This comes after Citigroup and Wells Fargo also increased their net interest income targets a week before.

- New data revealed that the UK economy contracted by 0.1% in May, largely down to an extra bank holiday in the month. While this fall was less than expected, economists are concerned that recent interest rises will hurt economic growth in the coming months.

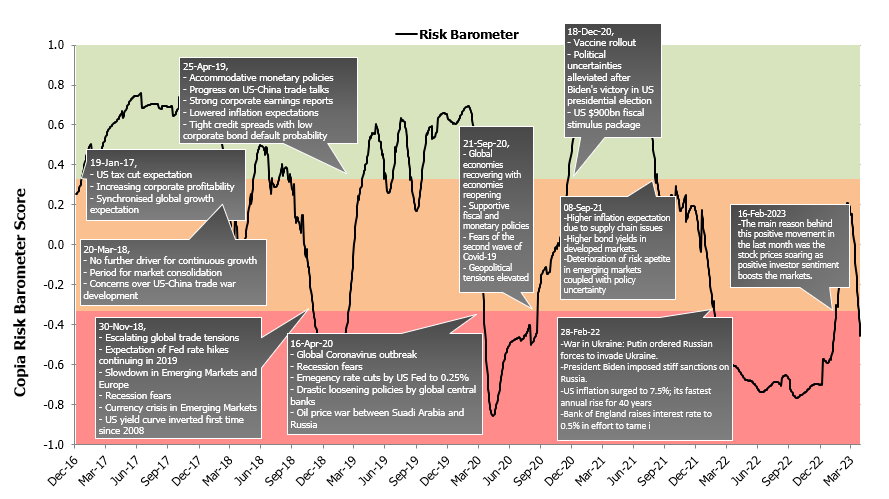

Market Pulse

Coming Up

- UK June CPI data released, July 19th, 7:00am

- EU June CPI data released, July 19th, 10:00am

- US Existing home sales data released, July 20th, 3:00pm

Notice:

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.Open document settingsOpen publish panel