The infoshot to help kick-start your week

Last Week

- Boris Johnson survived a no confidence vote. 211 Tory MPs voted for him, while 148 went against.

- US Inflation rose by more than expected again in May, destroying hopes that the rise in the cost of living had peaked. US inflation hit a new 40 year high of 8.6%, with record high gas prices and cost of services rising further, suggesting that the Federal Reserve (Fed) may continue with another 50 basis point increase in September.

- The European Central Bank (ECB) has confirmed that it intends to raise interest rates for the first time in more than 11 years next month in a bid to control soaring inflation in Europe. The hike will be 0.25% in July, with further increases planned for later in the year. The bank also intends to end its bond-buying stimulus programme on 1 July.

- The US dollar rose to a near four-week high against a basket of currencies on Friday, after May CPI data was released.

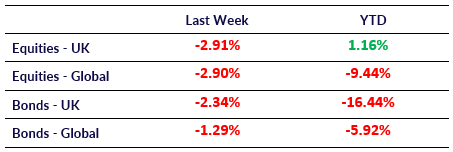

Market Pulse

Coming Up

- Fed interest rate decision to be released on 15th June, forecasted to be 1.5%.

- Bank of England interest rate decision to be released on 16th June, forecasted to be 1.25%.

- Eurozone CPI (YoY) data to be released on 17th June, forecasted to be 8.1%.

Notice:

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.Open document settingsOpen publish panel