The infoshot to help kick-start your week

Last Week

- Elon Musk was sued by Twitter Inc investors, who claim he manipulated the company’s stock price downward during the takeover bid.

- The UK signed its first trade agreement with the US state of Indiana, amid warnings that Boris Johnson’s stance on Brexit is hindering progress on a broader deal with Joe Biden’s administration.

- Global wheat prices pushed higher again as Russia rejected claims by the West that it is responsible for the shortage of grain on world markets. US Wheat Futures rose a further 1.0% to $1,154.30 a ton.

- U.S. personal spending stayed strong in April, rising by a stronger-than-expected 0.9% in the month, as inflation edged lower to 8.3%. The latter raised hopes that the US may now be around peak inflation.

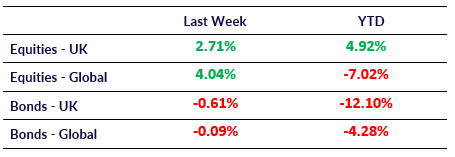

Market Pulse

Coming Up

- Eurozone CPI (YoY) to be released on 31st May, forecasted to be 7.7%.

- US ADP Nonfarm Employment Change to be released on 2nd June, forecasted to be 280K.

Notice:

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.Open document settingsOpen publish panel