The infoshot to help kick-start your week

Last Week

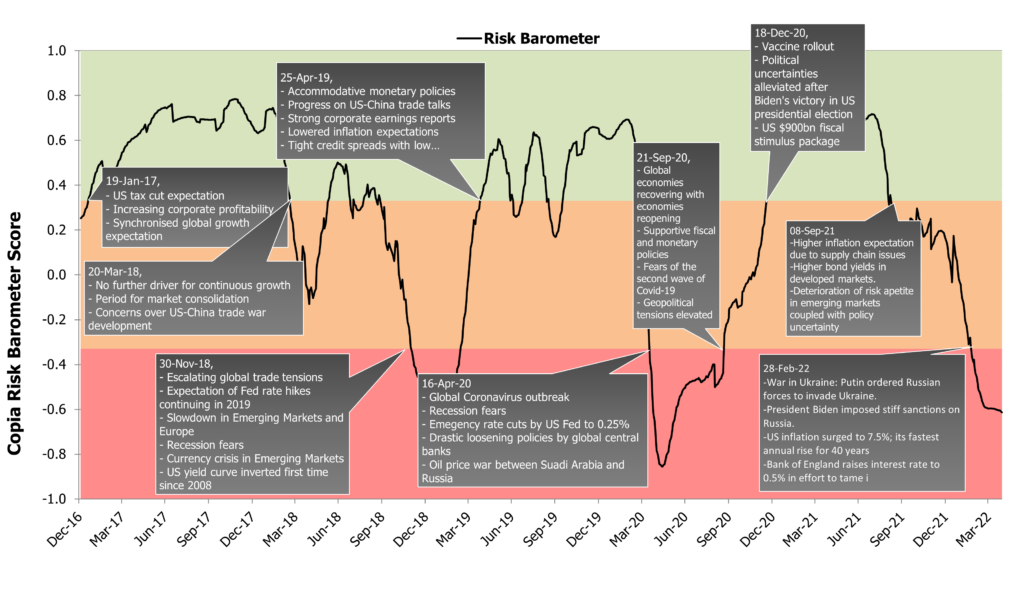

- In a bid to tackle inflation, the BoE raised interest rates by 0.25%, increasing rates to 1% – their highest level since 2009. The US Federal Reserve, also citing concerns about inflation, announced a 0.5% hike.

- The Fed has not delivered a rate hike on this scale in more than two decades. Markets responded sharply: a collapse in technology stocks caused the Nasdaq to slump, while the yields on US Treasuries climbed to multi-year highs in just a day. The Dow Jones Industrial Average slipped 3%, the Nasdaq fell 4.7%.

- Sterling fell to its lowest level against the dollar in nearly 2 years after dropping 2.2% on Thursday.

- The U.S. dollar hit 20-year highs and world stocks fell towards their lowest in over a year on Friday as markets anticipate more U.S. rate rises. Meanwhile Asian stocks fell on worries about the hit to growth from China’s zero-COVID policy.

- The U.S. created 428,000 non-farm jobs in April, more than forecasted, bringing the labour force back ever closer to its pre-pandemic level. Unemployment stayed at 3.6%, while the average hourly earnings rose 0.3%.

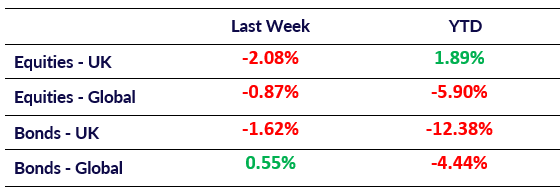

Market Pulse

Coming Up

- U.S. CPI (YoY) to be released on 11th May.

- UK GDP (YoY) to be released on 12th May, forecasted to be 9%.

A View from The Labour Party – Prospects for the Economy and the City

Friday 20th May, 1245-1345

Copia Capital is delighted to announce our next webinar with guest speaker Tulip Siddiq, the Labour MP for Hampstead and Kilburn. As a member of Labour’s Shadow Treasury team, Ms Siddiq will share an outline of Labour’s policies for the economy, the City and for the regulatory environment

To register, please click here.

Notice:

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.Open document settingsOpen publish panel