The infoshot to help kick-start your week

Last Week

- Netflix’s stock tumbled 40% , losing about $40 billion of its stock market value as it warned about lack of subscriber growth.

- A half-point interest rate increase “will be on the table” when the Federal Reserve meets in May to approve the next in what are expected to be a series of rate increases this year, Fed Chair Jerome Powell said in comments that pointed to an aggressive set of Fed actions ahead.

- Oil weakened over the week, burdened by the prospect of weaker global growth, higher interest rates and COVID lockdowns in China hurting demand even as the European Union considers a ban on Russian oil that would further tighten supply.

- Sterling fell to its lowest level since late 2020 versus the dollar on Friday, after data showed British retail sales dropped in March by more than expected. The British pound fell to as low as $1.2906 and finished the day down almost 0.5%. It also weakened against the euro and was down 0.4% at around 83.49 pence per euro.

- President Vladimir Putin claimed victory in the biggest battle of the Ukraine war so far, declaring the port of Mariupol “liberated” after nearly two months of siege, despite hundreds of defenders still holding out inside a giant steel works.

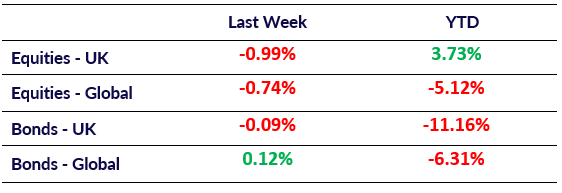

Market Pulse

Coming Up

- ECB Economic Bulletin to be released on the 28th

- US GDP (Q1) to be released on the 28th April, forecasted to be 1.0%.

- Eurozone CPI (YoY) to be released 29th April, forecasted to be 7.4%.

A View from The Labour Party – Prospects for the Economy and the City

Friday 20th May, 1245-1345

Copia Capital is delighted to announce our next webinar with guest speaker Tulip Siddiq, the Labour MP for Hampstead and Kilburn. As a member of Labour’s Shadow Treasury team, Ms Siddiq will share an outline of Labour’s policies for the economy, the City and for the regulatory environment

To register, please click here.

Notice:

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.Open document settingsOpen publish panel