The infoshot to help kick-start your week

Last Week

- Federal Reserve officials laid out a long-awaited plan to shrink their balance sheet by more than $1 trillion a year while raising interest rates “expeditiously” to counter elevated US inflation. The central bank said it will reduce its massive bond holdings at a maximum pace of $95 billion a month.

- Boris Johnson ramped up plans to build new nuclear power stations and offshore wind farms as he seeks to shore up the UK’s energy supplies in the wake of the Russian war in Ukraine. The premier’s energy security strategy targets a tripling of installed nuclear power capacity by 2050 and accelerates plans to install offshore wind farms this decade.

- The EU agreed to ban coal imports from Russia in its first move targeting Moscow’s crucial energy revenue.

- UK companies are raising starting salaries at the fastest pace on record as worsening labour shortages hand workers unprecedented bargaining power.

- One of the most shocking incidents yet in the six-week-long war happened this week. A Russian rocket artillery hit a train station in eastern Ukraine, killing over 30 people and injuring over 100 more.

- Russia’s central bank cut its key interest rate by 3 percentage points to 17%, saying that the balance of risks in the economy had shifted away from inflation to economic recession and financial instability.

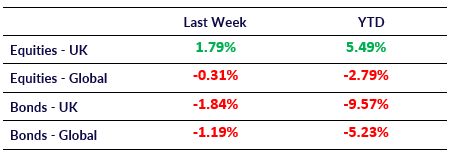

Market Pulse

Coming Up

- US CPI (YoY) to be released on the 12th April, forecasted to be 8.4%.

- UK CPI (YoY) to be released on the 13th April, forecasted to be 6.7%.

- ECB interest rate decision on the 14th April.

Notice:

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.Open document settingsOpen publish panel