The infoshot to help kick-start your week

Last Week

- Amazon announced its first stock split in more than two decades, telling investors that they intend to boost their outstanding shares by a 20-to-1 ratio.

- U.S. inflation hit 7.9% in February, a new 40 year high.

- UK GDP Data on Friday showed that the country’s economy grew by 0.8% in January, a stronger rebound than expected after December’s 0.2% contraction.

- In a week of volatile trading triggered by discussions of Russian oil embargoes then potential supply additions from Iran, Venezuela and the United Arab Emirates, while fighting escalated in Ukraine, Brent was on track for a weekly fall of 5.2% after reaching a 14-year high of $139.13 on Monday. Similarly, U.S. crude headed for a fall of 6.6% after hitting a high of $130.50 on Monday.

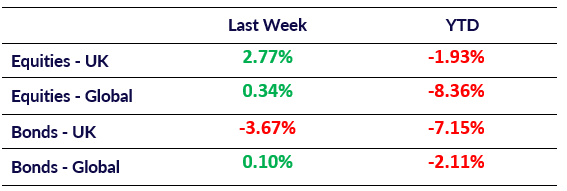

Market Pulse

Coming Up

- U.S. Fed interest rate decision on the 16th of March. Market expects a 0.25% rate hike.

- Eurozone CPI data to be released on the 17th of March, forecasted to be 5.8%.

- BoE interest rate decision on the 17th of March. Market expects a 0.25% rate hike.

Notice:

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.Open document settingsOpen publish panel