The infoshot to help kick-start your week

Last Week

- The Russian rouble tumbled to an all time low against the dollar and euro after Putin ordered Russian forces to invade Ukraine. Russia’s invasion saw investors scrambling for the safety of gold and the protection of inflation hedges.

- President Biden imposed stiff sanctions on Russia. Among the targets were five major banks which together hold around $1 trillion in assets. These include state backed Sberbank and VTB, as well as members of the Russian elite and their families.

- EU leaders backed a broad sanctions package that will limit Russia’s access to Europe’s financial markets and restrict key technologies.

- Ukraine’s military has suspended commercial shipping at its ports after Russian forces invaded the country, stoking fear of supply disruption from two of the world’s leading grain and oilseed exporters.

- Brent oil surged past $100 a barrel for the first time since 2014 as the escalation of the Ukraine crisis sparked fears of disruption to the region’s critical energy exports.

- JPMorgan economists said the Federal Reserve is likely to raise interest rates by 25 basis points at nine consecutive meetings in a bid to tamp down inflation. Goldman Sachs is forecasting seven hikes this year, up from its earlier prediction of five.

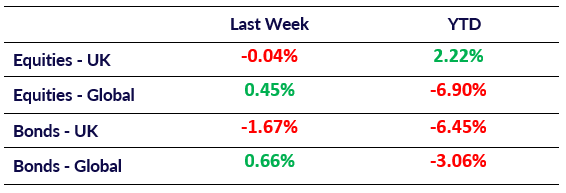

Market Pulse

Coming Up

- UK Annual Budget Release, March 2nd.

- Eurozone Unemployment rate to be released on March 3rd, forecasted to be 7.0%.

- U.S. Unemployment rate to be released on March 4th, forecasted to be 3.9%.

- Eurozone Retail Sales (YoY) to be released on March 4th, forecasted to be 9.5%.

Notice:

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.Open document settingsOpen publish panel