The infoshot to help kick-start your week

Last Week

- China’s economy slowed further in November, dragged down by a worsening property market slump and disruptions from repeated Covid outbreaks, which undercut consumer spending. Investment in fixed assets grew at its slowest in nearly two years in November, rising only 5.2%. Industrial production in China rose slightly more than expected but retail sales growth fell short, again.

- The Federal Reserve said on Wednesday it would end its pandemic-era bond purchases in March and pave the way for three quarter-percentage-point interest rate hikes by the end of 2022 as the economy nears full employment and the U.S. central bank copes with a surge of inflation.

- Boris Johnston suffered a big political upset as the Tories lost Thursday’s vote in North Shropshire, England – a rural seat that they have held since 1832 – to the Liberal Democrats.

- The Bank of England raised interest rates on Thursday to 0.25%, becoming the first major central bank in the world to raise borrowing costs since the pandemic hit last year

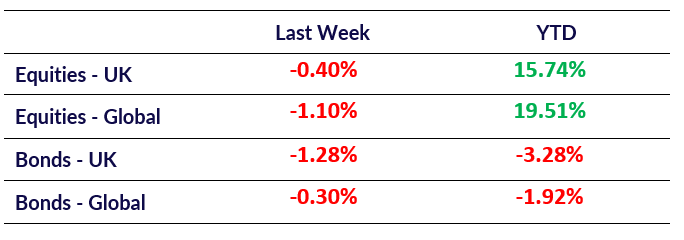

Market Pulse

Coming Up

- U.S. GDP QoQ to be released on December 22nd, forecasted to be 2.1%.

- UK GDP YoY to be released on December 22nd, forecasted to be 6.6%.

Notice:

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.Open document settingsOpen publish panel