The infoshot to help kick-start your week

Last Week

- The 2-year US Treasury yield increased 9bps to 3.138% on 13th July, while its 10-year counterpart slid almost 4bps to 2.919%, leading the inversion between the pair to its highest level since 2000, sending worrying recession signals.

- Increased recession fears and the ECB lagging behind others in raising interest rates has contributed to the weakening of the euro, as it falls below the dollar for the first time in 20 years.

- US inflation rate is now at its highest level since November 1981, having risen from 8.6% in May.

- China’s economy suffers its lowest growth rate since 2020 following months of stringent Covid lockdowns.

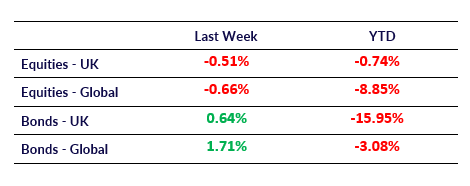

Market Pulse

Coming Up

- ECB Interest Rate decision will be released 21st July, forecasted to be a 25 basis point hike.

- US Philadelphia Fed Manufacturing Index released 21st July, forecasted to be 5.5, increasing from -3.3 in June.

- BoJ Quarterly Outlook Report (YoY) Released 21st July.

Notice:

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.Open document settingsOpen publish panel