The infoshot to help kick-start your week

Last Week

The UK economy saw no growth in February, following a surprise 0.4% jump in growth in January. A rise in construction activity and retail sales was largely offset by strikes from teachers and civil servants. Despite the flat performance, chancellor Hunt stated that the outlook was ‘brighter than expected’, noting that the economy had grown 0.1% in the three months to February.

ECB policymakers are reconsidering their plan for the path of interest rate hikes in light of last month’s banking turmoil but remain committed to reining in inflation. While panic at the time led to a slide in bank stocks worldwide, the market has calmed since, coming to a consensus that the failures were idiosyncratic in nature. Both the Austrian National Bank and Bank of Italy governors reflected on the events, noting that while inflation is still in full focus, the ECB’s Governing Council should rethink the scale of their approach.

Better than expected first-quarter earnings reports last Friday from JP Morgan, Citigroup and Wells Fargo helped to buoy sentiment in markets, which were the victim of significant turmoil last month due to banking sector chaos. The upbeat news speaks well of the US financial system and lessens the likelihood of any premature rate reductions. All eyes remain on the US ahead of this week, as investors look ahead for results from the likes of Bank of America and Morgan Stanley.

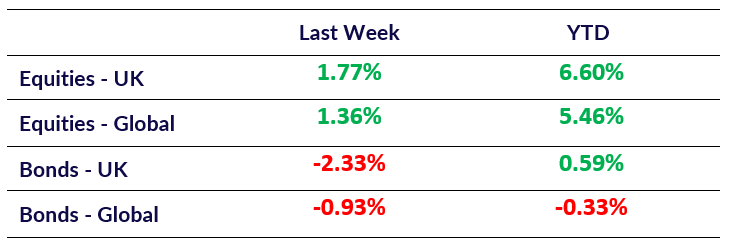

Market Pulse

Coming Up

- UK CPI (Mar YoY) data released April 19th, 7:00 am.

- EU CPI (Mar YoY) data released April 19th, 10:00 am.

Notice:

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.Open document settingsOpen publish panel