The infoshot to help kick-start your week

Last Week

- U.S. Inflation jumped to 6.2% in October, biggest monthly rise in 30 years.

- Sterling fell to its lowest level of 2021 against the dollar on Thursday as the British economy appeared to lose momentum and a surge in U.S. inflation boosted the dollar.

- Elon Musk has sold around $5bn of shares in Tesla – The company’s shares fell by around 16% in the two days after the poll came out, before regaining some ground on Wednesday.

- European shares chalked up new highs on Friday. The STOXX index of 600 companies was up 0.09%, enough to eke out a new record high for a second day running.

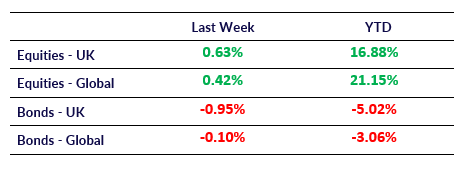

Market Pulse

Coming Up

- UK Consumer Price Index (CPI) MoM to be released on November 17th, forecasted to be 0.8%

- UK Consumer Price Index (CPI) YoY to be released on November 17th, forecasted to be 3.9%

Copia Capital Management relaunches Select Thematic portfolio

We’re delighted to announce the relaunch of one of our portfolios, which will now be known as Select Thematic. Previously known as Smart Beta, and before that as Enhanced Equity, the portfolio is focused on maximising returns over the long term through the use of thematic and factor investing in macro-trends.

Copia’s Select Thematic portfolio has been created to complement our overall product portfolio proposition, offering an alternative choice within our wider range of ‘ready to go’ portfolios. The objective of Select Thematic is to maximise returns within very broad volatility constraints through exposure to relevant themes and factors in today’s world.

Notice:

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.Open document settingsOpen publish panel