The infoshot to help kick-start your week

Last Week

- The UK economy contracted 0.1% in Q2, leading some to believe that the onset of recession may be closer than initially expected, with continued contraction for the next three quarters. However, analysts at Goldman Sachs believe we are in fact still on track for 0.4% growth in Q3, with HSBC echoing this sentiment.

- Despite some positive signs earlier this week that inflation may be easing, the Fed is unlikely to pivot from its hawkish stance on rate hikes. The Fed’s Bullard said that the rate hikes will continue until the central bank sees ‘compelling’ evidence that inflation is falling, suggesting we are still some time away from the Fed turning dovish on rates.

- Asian shares rallied, with the Hang Seng rising 2.1%, and European stocks ticked higher on Thursday, as investors hold high hopes that the Fed will soften its approach to tackling inflation. However, experts warn it is too early to ‘declare victory’ over inflation.

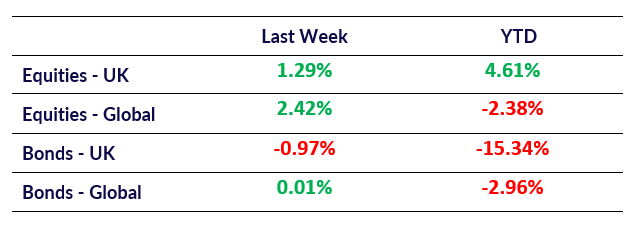

Market Pulse

Coming Up

- UK Average Earnings Index (Jun) data released August 16th, predicted to decrease by 1.7% from 6.2%

- UK headline inflation (Jul YoY) released August 17th, forecasted to rise 0.4%, from 9.4% in June

- EU headline inflation (Jul YoY) released August 18th, predicted to remain steady at 8.9%

Notice:

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.Open document settingsOpen publish panel