The infoshot to help kick-start your week

Last Week

The UK grew weakly in the first quarter of 2023, with the economy continuing to be battered by strikes and the cost of living. The economy grew 0.1% over the quarter, although it decreased by 0.3% in March, attributed to reduced car sales and poor retail activity. The data comes alongside an announcement from the BoE, in which they stated that the UK will avoid a recession completely, in a record growth upgrade.

Inflation in the US dropped to its lowest rate in two years, as incoming data last week showed that prices rose 4.9% in the year to April. Among the drivers were sharp falls in the prices of milk, airline tickets, and new cars. However, officials hesitate to declare victory, as other sectors of the economy continue to rise in price. The data shows that the prices of housing, petrol and old cars all shot up between March and April, indicating that inflation is widespread within the economy.

The BoE raised rates in the UK by 25 basis points, bringing the rate up to 4.5% – the highest in almost 15 years. However, despite the rapid interest rate hikes, prices are not slowing as quickly as predicted, attributed largely to prices in UK supermarkets remaining high despite a fall in wholesale food prices. While Governor Bailey said this was to be expected, food prices are expected to come down rapidly through the course of the year.

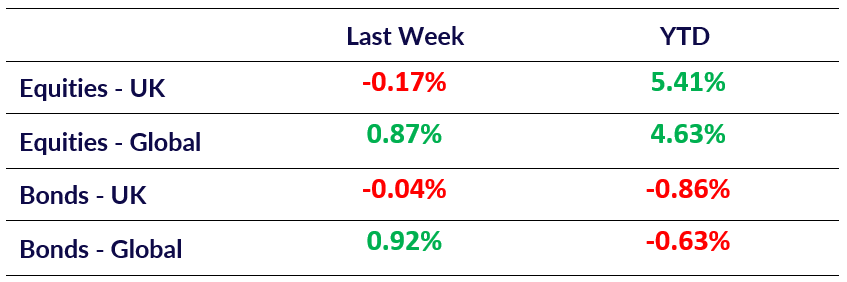

Market Pulse

Coming Up

- EU CPI (YoY Apr) data released May 17th, 10:00 am.

- US Initial Jobless Claims data released May 18th, 1:30 pm.

Notice:

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.Open document settingsOpen publish panel