The infoshot to help kick-start your week

Last Week

- Amazon is more than doubling the maximum base salary it pays its managers to $350,000 from $160,000. Media reports indicate the turnover rate inside Amazon has reached crisis level, with a record 50 vice presidents departing last year.

- Crude oil touched $90/bbl; allowing oil majors to power the FTSE 100 to a new 2-year high, crossing above 7,600. Compared to its global peers, the FTSE 100 has been one of the best performing equity indices so far in 2022.

- US inflation surged to 7.5%; its fastest annual rise for 40 years, driving US stocks lower on Thursday. The technology-heavy Nasdaq Composite closed 2.1% lower as prospects of tighter monetary policy pressured the valuations particularly of high growth businesses.

- UK GDP rose 7.5% over 2021 compared with the previous year, the strongest pace growth since 1940.

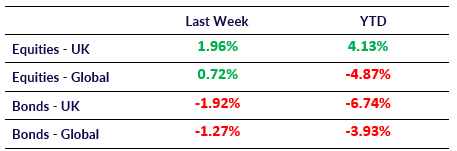

Market Pulse

Coming Up

- Eurozone GDP (YoY) data to be released on 15th February, forecasted to be 4.6%.

- China CPI (YoY) data to be released on 16th February, forecasted to be 1.0%.

- UK CPI (YoY) data to be released on 16th February, forecasted to be 5.4%.

Notice:

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.Open document settingsOpen publish panel