The infoshot to help kick-start your week

Last Week

- Updated figures from Eurostat last week indicate that the Eurozone fell into recession this winter. Originally, the 20-nation bloc was estimated to have expanded by 0.1% between January and March; revised data suggests a 0.1% contraction. Revised data from Germany, Europe’s largest economy, contributed to the move, as its economy shrunk by 0.3% in Q1 2023. Riccardo Fabiani, an economist at Oxford Economics, says he expects only “soft growth” in the coming quarter, as inflationary pressures are still present.

- The AI frenzy that has driven massive inflows into tech stocks is making a pause, according to Bank of America analysts. Tech funds sustained $1.2 bn of outflows in the week through June 7, their first in 8 weeks. The move came after record inflows in the week prior. Markets are grappling with the possibility of another rate hike this week, despite weaker-than-expected job data. The potential for rising rates and a liquidity drain are incoming negative risks for longs in AI and US tech in the quarter to come.

- Global bonds are slumping after two shock rate hikes last week served a reality check to traders. The Bank of Canada joined the Reserve Bank of Australia in surprising markets with more rate hikes to combat fast consumer-price gains. The tightening is forcing traders to rethink existing bets on Fed rate cuts later this year, underlining that the disinflation process may be slower than expected.

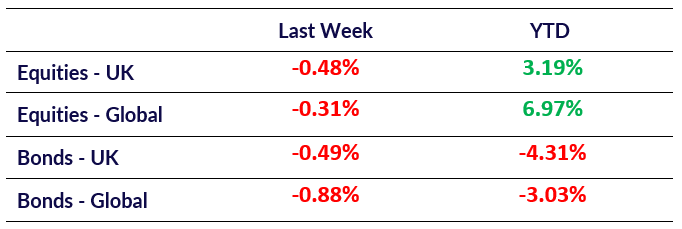

Market Pulse

Coming Up

- US CPI (YoY May) data released June 13th, 1:30 pm.

- Fed Interest Rate Decision released June 14th, 7:00 pm.

- ECB Interest Rate Decision released June 15th, 1:15 pm.

- EU CPI (YoY May) data released June 16th, 10:00 am.

Notice:

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.Open document settingsOpen publish panel