The infoshot to help kick-start your week

Last Week

Oil prices surged last week following surprise cuts in production from several of the world’s largest exporters. Saudi Arabia, Iraq and several Gulf states announced they were cutting production by more than one million barrels a day, and Russia announced that it would extend its half-million cut until the end of the year. The price of Brent crude jumped around 6%, and energy giants BP and Shell saw their share prices rise by over 4% on Monday.

The British Retail Consortium reported that sales of home accessories and furniture rose sharply in March, as the rising cost of living pushed more families to entertain at home, rather than eat out. Inflation rose 10.4% in the year to February. The BRC said this helped total retail sales increase by 5.1% last month, compared with a year earlier. Paul Martin, UK head of retail at KPMG said that the trend is likely to continue through April, as council tax, mobile and utility bills rise.

The Cold Chain Federation, which represents chilled food traders, expressed concerns that the new plans for post-Brexit border checks on incoming goods could result in a “painful realignment with significant short-term disruption.” Despite the government’s ongoing support of the proposals, the changes, which involve increased costs for exporters, could push up food prices, hindering an already sticky inflation situation.

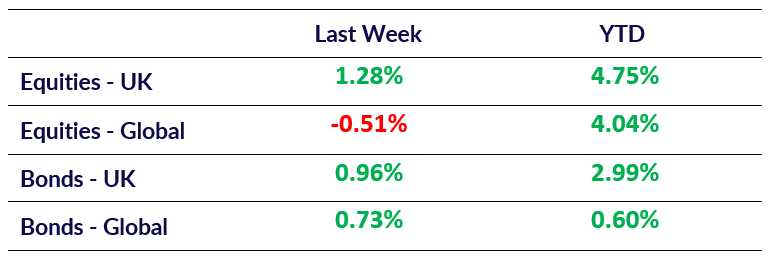

Market Pulse

Coming Up

- US CPI (Mar YoY) data released April 12th, 1:30 pm.

- UK GDP (Feb MoM) data released April 13th, 7:00 am.

Notice:

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.Open document settingsOpen publish panel