The infoshot to help kick-start your week

Last Week

Last week saw both the Fed and ECB raise rates by 25 bps each. The move pushed US interest rates to the highest level in 16 years; it’s 10th hike in 14 months. In the EU, the hike was smaller than the previous three meetings. Following the announcement, Fed chair Powell stated that they ‘no longer anticipate’ additional interest rate hikes, although was clear that the decisions will be made based on the latest data; US CPI is set to come out later this week.

UK house prices rose by 0.5% in April, after seven consecutive months of decline, according to Nationwide, despite expectations of another month of contraction. Nationwide predict a “modest recovery” in the market as rates start to come down, but any rebound is likely to be fairly muted, as households remain under pressure as average earnings fail to keep pace with inflation. Despite last month’s increase, prices remain 2.7% lower than last year.

Some regional US bank shares last week dropped sharply, as confidence in the country’s banking sector continues to be tested. Investors are reeling from the recent string of bank failures and are fleeing smaller lenders. California-based PacWest plunged 50% while Western Alliance also fell around 40%. The US Treasury Department stated however that it was monitoring developments ‘closely’, reassuring investors that the banking system has ‘substantial liquidity and deposit flows are stable’.

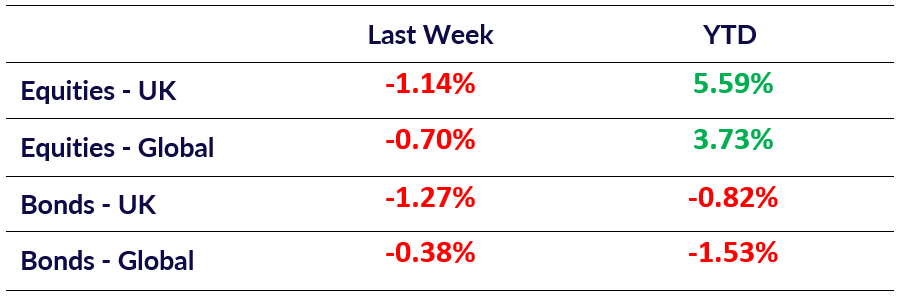

Market Pulse

Coming Up

- US CPI (YoY Apr) data released May 10th, 1:30 pm.

- BoE Interest Rate Decision released May 11th, 12:00 pm.

Notice:

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.Open document settingsOpen publish panel