The infoshot to help kick-start your week

Last Week

- Sterling held near a one-year low on Friday, extending its losses after the Bank of England surprised the market by leaving interest rates unchanged on Thursday.

- The FTSE 100 rallied on Thursday with a closing price of 7280.30, +0.4%.

- A trial of Pfizer Inc (NYSE:PFE)’s experimental antiviral pill for COVID-19 was stopped early after the drug was shown to cut by 89% the chances of hospitalization or death for adults at risk of developing severe disease, the company said on Friday.

- The dollar was trading near one-year highs versus major peers on Friday ahead of a U.S. jobs report and after a string of central banks this week pushed back against faster tightening of monetary policy.

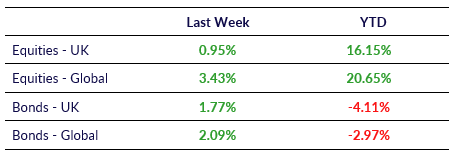

Market Pulse

Coming Up

- China Consumer Price Index (CPI) MoM to be released on November 10th, forecasted to be 0.6%.

- S. Consumer Price Index (CPI) MoM to be released on November 10th, forecasted to be 0.5%.

Select Blended

We’re delighted to announce the launch of our new Select Blended portfolio range offering a blend of active and index tracking funds. Available on twelve different investment platforms, the range is designed for clients with long-term investment horizons.

Select Blended offers advisers a choice of five portfolios to match their clients’ risk return preferences. Designed to grow and preserve capital over the medium-to long-term, the portfolios use a blend of active and index tracking funds and are designed for clients with long term investment horizons, where there is a need for a portfolio diversified across multiple asset classes and geographies with different risk return profiles relative to global equity risk.

Notice:

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.Open document settingsOpen publish panel