The infoshot to help kick-start your week

Last Week

- European stock markets slumped Friday, starting the fourth quarter on a weak note with concerns rising inflation will prompt central banks to withdraw stimulus just as growth slows. At 3:25 AM ET (0725 GMT), the DAX in Germany traded 1.1% lower, the CAC 40 in France fell 1% and the U.K.’s FTSE 100 dropped 0.8%.

- Oil prices climbed above $80 (£59) a barrel on Tuesday, hitting their highest level in three years as the pound slumped.

- Britain’s financial sector has called on the government to ease visa requirements on overseas staff who want to work up to six months in the country to maintain global competitiveness.

- British airline easyJet (LON:EZJ) said its investors had bought 93% of the new shares on offer in its 1.2 billion pound ($1.64 billion) rights issue, designed to help fund its recovery from the pandemic.

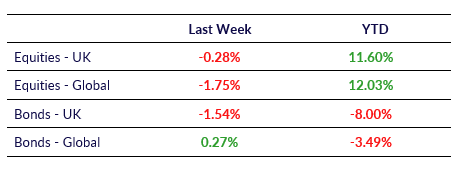

Market Pulse

Coming Up

- Eurozone services PMI to be announced on Tuesday 5th October, forecasted 56.3.

- US unemployment rate to be announced on Friday 8th

Notice:

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.Open document settingsOpen publish panel