The infoshot to help kick-start your week

Last Week

Last week, the UK signed a deal to join the Comprehensive and Progressive Agreement for Trans-Pacific Partnership – or CPTPP, which is a trade pact with 11 Asia and Pacific nations, 3 years after its official exit from the EU. While joining the group will boost UK exports by cutting tariffs on goods such as cheese, chocolate and whisky, the government estimates that being in the bloc will only add 0.08% to the size of the UK’s economy.

Revised figures from the ONS suggest that the UK economy performed better than initially estimated at the end of last year. While previously released data suggested a contraction, the new data released last week suggest the economy grew 0.1% in the final quarter of 2022. While the figures confirm the UK economy showed some resilience and did not fall into recession at the end of 2022, consumers across the country continue to face the pressure of the current economic situation.

A central theme at the Ambrosetti Forum in Italy on Thursday and Friday was the potential for further instability in financial markets following the recent problems in the banking sector; particularly against a backdrop of tightening financial conditions. The collapse of SVB earlier in March, along with the emergency rescue of Credit Suisse prompted contagion fears. However, policymakers on both sides of the Atlantic pledged further support to the system if needed, causing markets to stage a recovery last week.

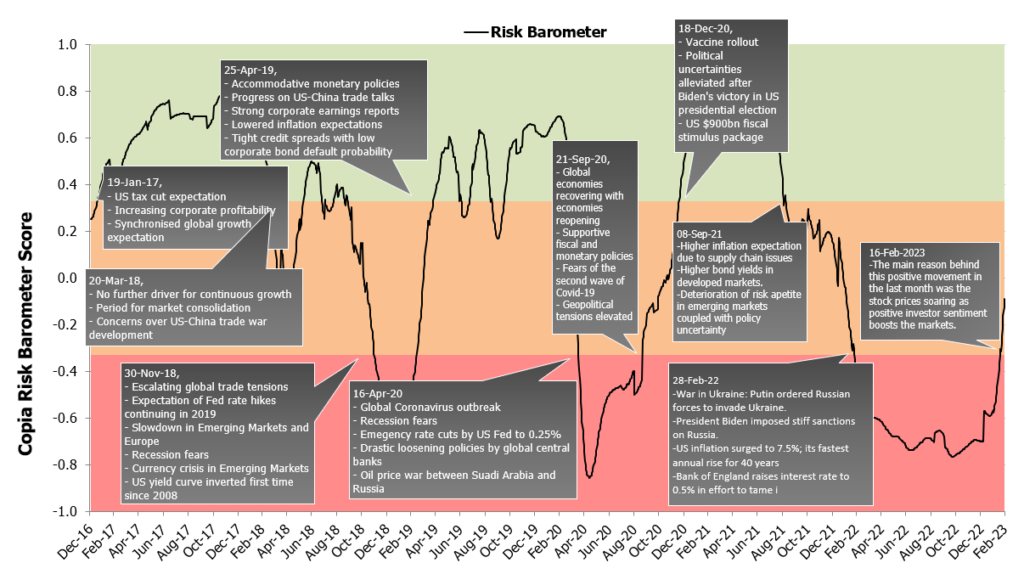

Market Pulse

Coming Up

- US Nonfarm Payrolls data released April 7th, 1:30 pm.

- US Unemployment rate released April 7th, 1:30 pm.

Notice:

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.Open document settingsOpen publish panel