The infoshot to help kick-start your week

Last Week

The US economy slowed in the first quarter of 2023, as businesses reduce investment in the face of higher borrowing costs. The economy grew 1.1% on an annualised basis, down from 2.6% in the previous quarter. The economy contracted in the first half of last year following a sharp decrease in home sales. More recently, a strong job market has kept consumer spending – the main driver of economic activity – resilient, as analysts weigh up the probability of a recession.

BP posted profits of $5bn in the first quarter of the year, as energy prices remain high. While this is down from $6.2bn last year with oil prices having fallen from the peak seen after Russia’s invasion, it has led to the latest in a number of calls for energy firms to pay higher taxes. Nick Butler, a former BP executive, stated that the profits come from ‘good internal business performance’ as well as high global prices. He noted however, that he expects profits to come down this year as oil and gas prices fall back.

Regulators seized control of First Republic Bank and solid it to JPMorgan Chase on Monday, a dramatic move aimed at curbing a two-month banking crisis that has rattled the financial system. It is the largest of the 3 failures year to date, and the second-largest US bank by assets to collapse, trailing Washington Mutual which failed in 2008. Jamie Dimon, JPMorgan’s chief executive said “this part of the crisis is over” and the move was actually taken positively by investors, sending JPM’s stock 3.5% higher on Monday.

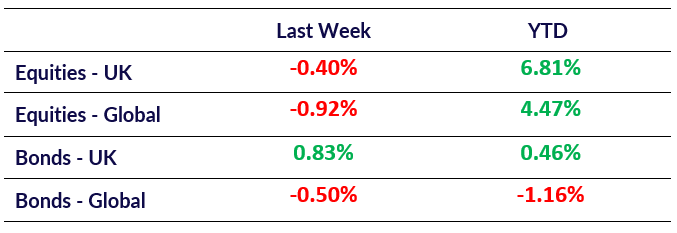

Market Pulse

Coming Up

- Fed Interest Rate Decision released May 3rd, 7:00 pm.

- ECB Interest Rate Decision released May 4th, 1:15 pm.

Notice:

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.Open document settingsOpen publish panel