![]()

![]() On Wednesday September 4, UK MPs passed a bill that requires Boris Johnson to secure a Brexit deal with the EU and seeks further extension on Brexit date until January 31 2020, if the deal cannot be reached before and by October 19.

On Wednesday September 4, UK MPs passed a bill that requires Boris Johnson to secure a Brexit deal with the EU and seeks further extension on Brexit date until January 31 2020, if the deal cannot be reached before and by October 19.

![]() During last week, the US and UK manufacturing PMI for August were released, both showing weakness. The US manufacturing PMI fell to 50.3 from 50.4 in July, the lowest level in 10 years, impacted by fast dropping exports. The UK manufacturing PMI slid to 47.4, contracting at the fastest rate in seven years with the business confidence standing at a record low level.

During last week, the US and UK manufacturing PMI for August were released, both showing weakness. The US manufacturing PMI fell to 50.3 from 50.4 in July, the lowest level in 10 years, impacted by fast dropping exports. The UK manufacturing PMI slid to 47.4, contracting at the fastest rate in seven years with the business confidence standing at a record low level.

![]() On Thursday September 5, China announced that the next face-to-face trade talk in October with the US had been agreed between two economies over a phone conversation and claimed that the negotiation went very well. After the announcement, the US and Asian stocks jumped and the US Treasury yield was pushed up.

On Thursday September 5, China announced that the next face-to-face trade talk in October with the US had been agreed between two economies over a phone conversation and claimed that the negotiation went very well. After the announcement, the US and Asian stocks jumped and the US Treasury yield was pushed up.

![]() On Friday September 6, the US nonfarm payrolls were published showing an increase of 130,000 in August, missing the expectation of 160,000. The unemployment rate remained unchanged at 3.7%.

On Friday September 6, the US nonfarm payrolls were published showing an increase of 130,000 in August, missing the expectation of 160,000. The unemployment rate remained unchanged at 3.7%.

![]()

![]()

![]() China CPI for August will be announced on Tuesday September 10, with an expectation of 2.6% YoY.

China CPI for August will be announced on Tuesday September 10, with an expectation of 2.6% YoY.

![]() On Thursday September 12, US CPI for August will also be released, with an expectation of 1.8% YoY.

On Thursday September 12, US CPI for August will also be released, with an expectation of 1.8% YoY.

![]()

+0.58*

-1.0 A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

0.0 A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

+1.0 A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

*as at latest realignment 31/08/19

Notice:

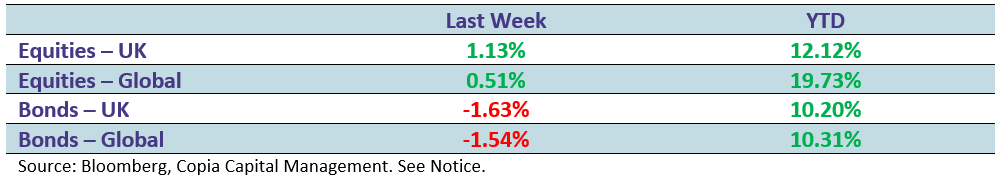

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.