![]()

![]() On Monday July 15, the annual GDP growth rate of China for Q2 2019 was released, slipping to a 27-year low of 6.2% as expected while the growth on factory output, urban investment and retails sales has seen some improvement, beating the forecast.

On Monday July 15, the annual GDP growth rate of China for Q2 2019 was released, slipping to a 27-year low of 6.2% as expected while the growth on factory output, urban investment and retails sales has seen some improvement, beating the forecast.

![]() On Tuesday July 16, JP Morgan and Goldman Sachs published earnings reports for Q2. JPM reported a 3.6% revenue growth and the EPS increased by 23.1% to $2.82 compared to Q2 2018. Goldman Sachs however reported a decline in earnings to $5.81 per share or 2.8% lower than the same period last year.

On Tuesday July 16, JP Morgan and Goldman Sachs published earnings reports for Q2. JPM reported a 3.6% revenue growth and the EPS increased by 23.1% to $2.82 compared to Q2 2018. Goldman Sachs however reported a decline in earnings to $5.81 per share or 2.8% lower than the same period last year.

![]() The prices of precious metals jumped during last week due to the fears of global recession. Silver saw the highest price in one year and gold price reached a six-year high on Thursday July 18 at $1,445.93 per ounce.

The prices of precious metals jumped during last week due to the fears of global recession. Silver saw the highest price in one year and gold price reached a six-year high on Thursday July 18 at $1,445.93 per ounce.

![]() On Friday July 19, the oil price went up with a surge in crude buying. Markets sensed the intensified tensions between the US and Iran after Trump saying that the US Navy shot down an Iranian drone in defensive action.

On Friday July 19, the oil price went up with a surge in crude buying. Markets sensed the intensified tensions between the US and Iran after Trump saying that the US Navy shot down an Iranian drone in defensive action.

![]()

![]()

![]() US Manufacturing PMI will be released on Wednesday July 24 and is expected to come in at 51.2.

US Manufacturing PMI will be released on Wednesday July 24 and is expected to come in at 51.2.

![]() Eurozone Composite PMI will be released on the same day, Wednesday July 24 and is forecast at 52.1.

Eurozone Composite PMI will be released on the same day, Wednesday July 24 and is forecast at 52.1.

![]()

+0.26*

-1.0 A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

0.0 A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

+1.0 A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

*as at latest realignment 15/07/19

Notice:

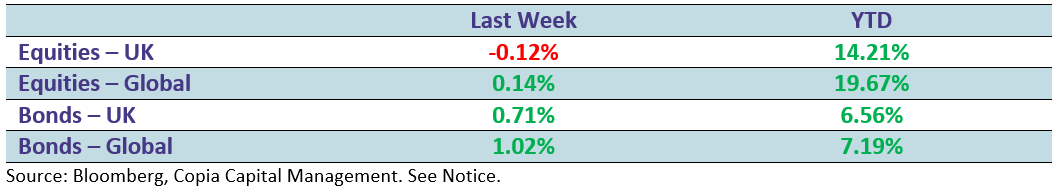

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.