![]()

![]() On Monday 21 January, Theresa May outlined eight amendments to the withdrawal agreement rejected by Parliament last Tuesday. The changes are focused on ensuring that the border remains open on the island of Ireland and extending the deadline of the UK leaving the EU

On Monday 21 January, Theresa May outlined eight amendments to the withdrawal agreement rejected by Parliament last Tuesday. The changes are focused on ensuring that the border remains open on the island of Ireland and extending the deadline of the UK leaving the EU

![]() On Tuesday 22 January, British technology company Dyson announced that the company’s headquarter will be moved from the UK to Singapore. On Wednesday January 23, the Japanese conglomerate Sony also announced a decision to relocate its legal base from London to Amsterdam due to the uncertainty of Brexit. On Thursday January 24, the plane maker Airbus warned to redirect its future investments from the UK in the case of no-deal Brexit.

On Tuesday 22 January, British technology company Dyson announced that the company’s headquarter will be moved from the UK to Singapore. On Wednesday January 23, the Japanese conglomerate Sony also announced a decision to relocate its legal base from London to Amsterdam due to the uncertainty of Brexit. On Thursday January 24, the plane maker Airbus warned to redirect its future investments from the UK in the case of no-deal Brexit.

![]() On Thursday, the UK café chain Patisserie Valerie confirmed a list of 71 stores that will be closed over the next year as the company has been unable to renew its bank loans. In October 2018, the company was found overstating its profits in at least the past three years.

On Thursday, the UK café chain Patisserie Valerie confirmed a list of 71 stores that will be closed over the next year as the company has been unable to renew its bank loans. In October 2018, the company was found overstating its profits in at least the past three years.

![]() Also on Thursday, the ECB decided to keep the current monetary policies, which means the benchmark interest rate will stay at 0% and the base deposit rate at -0.4%.

Also on Thursday, the ECB decided to keep the current monetary policies, which means the benchmark interest rate will stay at 0% and the base deposit rate at -0.4%.

![]()

![]()

![]() On Thursday 31 January, China Manufacturing PMI for January will be revealed, which is expected at 49.3.

On Thursday 31 January, China Manufacturing PMI for January will be revealed, which is expected at 49.3.

![]() The US unemployment rate will be released on Friday 1 February and is expected at 3.8%.

The US unemployment rate will be released on Friday 1 February and is expected at 3.8%.

![]()

-1.0 A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

0.0 A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

+1.0 A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

*as at latest realignment 17/01/19

Notice:

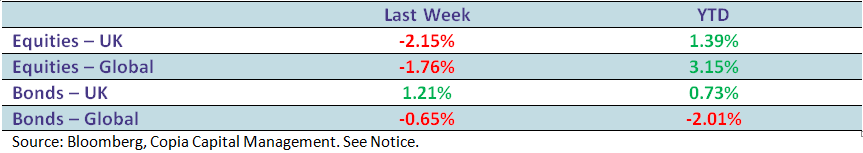

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.