![]()

![]() Fed’s minutes for the last meeting in late September were released on Wednesday October 17, which revealed policymakers’ decision to continue a gradual interest rate hike in the future, in consideration of a sustained expansion of the US economy. Some members warned about the impact of higher rates on emerging economies that are heavily indebted.

Fed’s minutes for the last meeting in late September were released on Wednesday October 17, which revealed policymakers’ decision to continue a gradual interest rate hike in the future, in consideration of a sustained expansion of the US economy. Some members warned about the impact of higher rates on emerging economies that are heavily indebted.

![]() On Thursday October 18, Theresa May indicated the possibility of a few months’ extension on the post-Brexit transition period unless the new trade deal with the EU will be in place by December 2020.

On Thursday October 18, Theresa May indicated the possibility of a few months’ extension on the post-Brexit transition period unless the new trade deal with the EU will be in place by December 2020.

![]() Also on Thursday, the Chinese Yuan fell to an almost two-year low, after a more than 9% drop against USD in the past six months, given the backdrop of a slowing economic growth and escalating trade war with the US.

Also on Thursday, the Chinese Yuan fell to an almost two-year low, after a more than 9% drop against USD in the past six months, given the backdrop of a slowing economic growth and escalating trade war with the US.

![]() The Swiss Pharmaceutical company Novartis announced an acquisition deal worth of $2.1bn to buy Endocyte, a US pharmaceutical firm focusing on prostate cancer, aiming to grow business in the radiopharmaceutical area. Endocyte share price jumped 50% following the news.

The Swiss Pharmaceutical company Novartis announced an acquisition deal worth of $2.1bn to buy Endocyte, a US pharmaceutical firm focusing on prostate cancer, aiming to grow business in the radiopharmaceutical area. Endocyte share price jumped 50% following the news.

![]()

![]()

![]() The US GDP growth will be released on Friday October 26, at an expected rate of 3.3% annualised growth.

The US GDP growth will be released on Friday October 26, at an expected rate of 3.3% annualised growth.

![]() On Thursday October 25, the ECB will announce their decision on the Eurozone interest rate , which is expected to stay at 0.0%.

On Thursday October 25, the ECB will announce their decision on the Eurozone interest rate , which is expected to stay at 0.0%.

![]()

-1.0 A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

0.0 A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

+1.0 A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

*as at latest realignment 15/10/18

Notice:

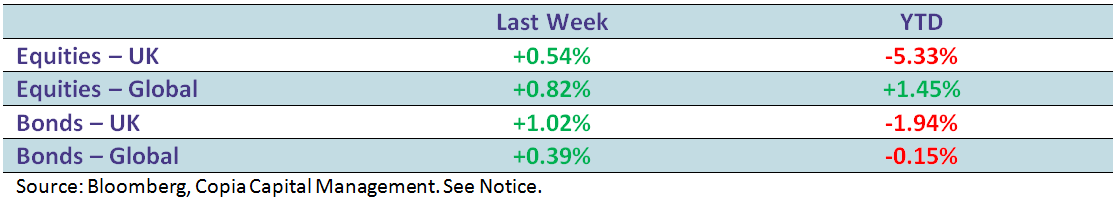

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future