![]()

![]() OPEC indicated that it is not urgent for them to increase oil output as the current demand in oil market can be met by the supply. This resulted in the oil price (Brent) topping at $81.48 per barrel on Monday September 24; the first time to break $80 per barrel since November 2014.

OPEC indicated that it is not urgent for them to increase oil output as the current demand in oil market can be met by the supply. This resulted in the oil price (Brent) topping at $81.48 per barrel on Monday September 24; the first time to break $80 per barrel since November 2014.

![]() On Wednesday September 26, the Fed announced the third hike of the US benchmark interest rate for 2018, which is now standing at 2.25%, 25bps higher than previous 2.00%. The Fed now expect the US economic growth to be 3.1% for 2018, compared to 2.8% predicted in June.

On Wednesday September 26, the Fed announced the third hike of the US benchmark interest rate for 2018, which is now standing at 2.25%, 25bps higher than previous 2.00%. The Fed now expect the US economic growth to be 3.1% for 2018, compared to 2.8% predicted in June.

![]() On Wednesday, China announced an average cut of tariffs from 9.8% to 7.5% on imports including machinery, electronics and textiles, following their tax reduction on around 1,500 products in July.

On Wednesday, China announced an average cut of tariffs from 9.8% to 7.5% on imports including machinery, electronics and textiles, following their tax reduction on around 1,500 products in July.

![]() On Wednesday, tech and advertising giants including Google, Facebook signed a voluntary code of practice set out by the European Commission, committing to tackle the issue of fake news dissemination.

On Wednesday, tech and advertising giants including Google, Facebook signed a voluntary code of practice set out by the European Commission, committing to tackle the issue of fake news dissemination.

![]()

![]()

![]() The US trade balance for August will be announced on Friday October 5, with an expected deficit at $48.5bn.

The US trade balance for August will be announced on Friday October 5, with an expected deficit at $48.5bn.

![]() The US unemployment rate will be released on Friday October 5 and is expected at 3.8%.

The US unemployment rate will be released on Friday October 5 and is expected at 3.8%.

![]()

-1.0 A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

0.0 A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

+1.0 A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

*as at latest realignment 31/08/18

Notice:

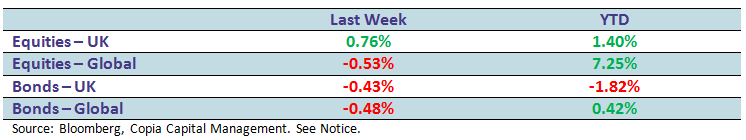

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future