![]()

![]() On Tuesday, Bank of Japan decided to keep its current extremely low interest rates with a negative short term rate of -0.1% and a 0% 10-year government bond yield, in order to achieve the 2% inflation target. However, the central bank said the yield could fluctuate depending on economic and price developments.

On Tuesday, Bank of Japan decided to keep its current extremely low interest rates with a negative short term rate of -0.1% and a 0% 10-year government bond yield, in order to achieve the 2% inflation target. However, the central bank said the yield could fluctuate depending on economic and price developments.

![]() On Thursday, Bank of England announced a rate hike from 0.5% to 0.75%, reaching the highest level in 10 years. Mark Carney, the Bank’s governor, said there would be further “gradual” and “limited” rate rises to come. However, he has raised the possibility of lowering the interest rate as part of contingency plans in the event of a no-deal Brexit.

On Thursday, Bank of England announced a rate hike from 0.5% to 0.75%, reaching the highest level in 10 years. Mark Carney, the Bank’s governor, said there would be further “gradual” and “limited” rate rises to come. However, he has raised the possibility of lowering the interest rate as part of contingency plans in the event of a no-deal Brexit.

![]() Royal Bank of Scotland has seen first-half profits fall, but is in on course to pay its first dividend in 10 years

Royal Bank of Scotland has seen first-half profits fall, but is in on course to pay its first dividend in 10 years

![]() Amazon is under pressure to pay more tax in the UK. Amazon Services UK, its retail logistics arm, paid tax of £1.7m, down from £7.4m in 2016, but operating profits rose from £48m to £80m.

Amazon is under pressure to pay more tax in the UK. Amazon Services UK, its retail logistics arm, paid tax of £1.7m, down from £7.4m in 2016, but operating profits rose from £48m to £80m.

![]() The 3rd quarter revenue growth for Apple was reported to be 17% YoY, with total revenue amounting to $53.2bn, making Apple the first company in the world to be worth $1trn.

The 3rd quarter revenue growth for Apple was reported to be 17% YoY, with total revenue amounting to $53.2bn, making Apple the first company in the world to be worth $1trn.

![]() Starbucks launched a partnership with Alibaba to expand its Chinese business by working on delivery services through Alibaba’s food delivery app. This is set to add more than 2,000 stores in 30 cities by the end of the year.

Starbucks launched a partnership with Alibaba to expand its Chinese business by working on delivery services through Alibaba’s food delivery app. This is set to add more than 2,000 stores in 30 cities by the end of the year.

![]()

![]()

![]() US CPI will be released on Friday August 10 and is expected to come in at 3.0% YoY.

US CPI will be released on Friday August 10 and is expected to come in at 3.0% YoY.

![]() On the same day, Friday August 10, UK GDP growth for 2nd quarter will be released, at an expected growth rate of 1.3% YoY.

On the same day, Friday August 10, UK GDP growth for 2nd quarter will be released, at an expected growth rate of 1.3% YoY.

.

![]()

![]() A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

![]() A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

![]() A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

*as at latest realignment 31/07/18

Notice:

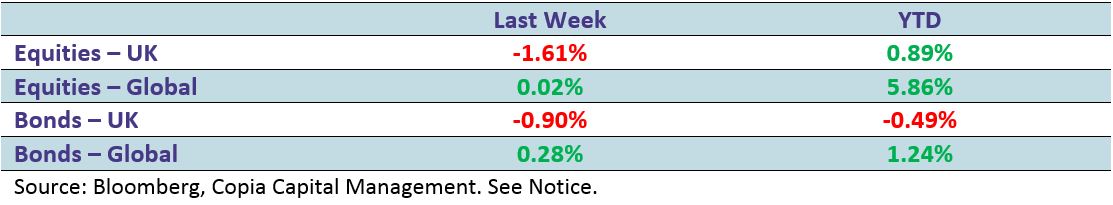

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.