![]()

![]() On Monday, U.S. stocks plunged deeper than it has previously in the last six years, triggered by concerns of faster interest rate hikes driven by higher inflation. Central Banks remain unfazed by recent market volatility, stating conditions remain conducive to economic growth.

On Monday, U.S. stocks plunged deeper than it has previously in the last six years, triggered by concerns of faster interest rate hikes driven by higher inflation. Central Banks remain unfazed by recent market volatility, stating conditions remain conducive to economic growth.

![]() Bank of England Governor, Mark Carney, said UK interest rates may need to rise at a steeper pace than previously thought, driving UK 10 year bond yields up to 1.6%.

Bank of England Governor, Mark Carney, said UK interest rates may need to rise at a steeper pace than previously thought, driving UK 10 year bond yields up to 1.6%.

![]() On Tuesday, the private company SpaceX launched its first rocket Falcon Heavy. SpaceX is now valued at $21.5 billion and its founder Elon Musk’s net worth is now put at $20.9 billion—a 73% increase from the day before launch.

On Tuesday, the private company SpaceX launched its first rocket Falcon Heavy. SpaceX is now valued at $21.5 billion and its founder Elon Musk’s net worth is now put at $20.9 billion—a 73% increase from the day before launch.

![]() After China reported a much narrower trade surplus than expected with imports soaring, the Chinese Yuan experienced its biggest one-day decline.

After China reported a much narrower trade surplus than expected with imports soaring, the Chinese Yuan experienced its biggest one-day decline.

![]()

![]()

![]() On Tuesday Feb 13, the CPI YoY for UK will be released. A decrease of 0.1% is expected from the previous 3.0%.

On Tuesday Feb 13, the CPI YoY for UK will be released. A decrease of 0.1% is expected from the previous 3.0%.

![]() The US will report its CPI YoY on Wednesday Feb 14. It is expected to drop from 2.1% to 1.9%.

The US will report its CPI YoY on Wednesday Feb 14. It is expected to drop from 2.1% to 1.9%.

![]() A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

![]() A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

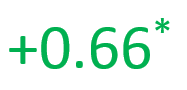

![]() A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

*as at latest realignment 31/01/18

Notice:

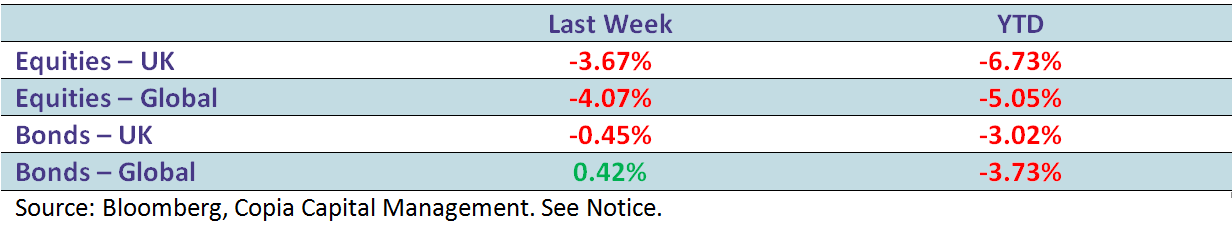

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.