![]() The US government revealed the details of Joe Biden’s $1.8trn American Families Plan on Wednesday April 28. The 10-year programme includes investments of $1trn and tax cuts of $800bn, aiming to help American families, children and workers, and will be financed by tax raise on households earning $1mn and more a year.

The US government revealed the details of Joe Biden’s $1.8trn American Families Plan on Wednesday April 28. The 10-year programme includes investments of $1trn and tax cuts of $800bn, aiming to help American families, children and workers, and will be financed by tax raise on households earning $1mn and more a year.

![]() US annualised GDP rose by 6.4% QoQ in the first quarter of 2021, slightly lower than the expectation of 6.5%, with the growth of consumption in goods stronger than in services sector.

US annualised GDP rose by 6.4% QoQ in the first quarter of 2021, slightly lower than the expectation of 6.5%, with the growth of consumption in goods stronger than in services sector.

![]() China’s Manufacturing PMI dropped more than expected in April, decreasing by 0.8 points to 51.1 compared to 51.9 in March. The decline was due to the global shortage of semiconductors according to the official report released.

China’s Manufacturing PMI dropped more than expected in April, decreasing by 0.8 points to 51.1 compared to 51.9 in March. The decline was due to the global shortage of semiconductors according to the official report released.

![]() India continued to see the surging number of Covid cases last week, with the recorded infections reaching a new high of 386,452 on Friday and 18,762,976 in total. The oil prices slid amid the demand concerns over the rising coronavirus cases and the expansion slowdown of China’s manufacturing sector.

India continued to see the surging number of Covid cases last week, with the recorded infections reaching a new high of 386,452 on Friday and 18,762,976 in total. The oil prices slid amid the demand concerns over the rising coronavirus cases and the expansion slowdown of China’s manufacturing sector.

![]() BoE Interest Rate decision will be announced on Thursday May 6, expected to remain at 0.1%.

BoE Interest Rate decision will be announced on Thursday May 6, expected to remain at 0.1%.

![]() US will publish the change in Nonfarm payrolls for April on Friday May 7, which is expected at 950K.

US will publish the change in Nonfarm payrolls for April on Friday May 7, which is expected at 950K.

-1.0 A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

0.0 A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

+1.0 A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

*as at latest realignment 16/04/21

Notice:

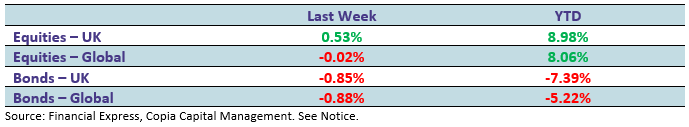

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.