![]()

![]() Thailand, South Korea, India and Japan saw a surge in Covid cases last week. Major cities in Japan including Tokyo, Osaka, Kyoto and Hyogo are expected to enter another state of emergency.

Thailand, South Korea, India and Japan saw a surge in Covid cases last week. Major cities in Japan including Tokyo, Osaka, Kyoto and Hyogo are expected to enter another state of emergency.

![]() The New York Times reported on Thursday April 22 that Biden is going to announce a raise on capital-gains tax for the top earners, increasing the top marginal income tax rate to 39.6%, and will use the money raised for education and childcare programs.

The New York Times reported on Thursday April 22 that Biden is going to announce a raise on capital-gains tax for the top earners, increasing the top marginal income tax rate to 39.6%, and will use the money raised for education and childcare programs.

![]() On Thursday, ECB decided to maintain the benchmark interest rate at 0%, with the marginal lending facility and the deposit facility rates at 0.25% and -0.50% respectively and indicted that will keep the pace of the bond buying programme PEPP significantly faster in this quarter. The ECB President Christine Lagarde expects the Eurozone GDP to return to pre-pandemic levels in H2 2022, possibly with some countries lagging.

On Thursday, ECB decided to maintain the benchmark interest rate at 0%, with the marginal lending facility and the deposit facility rates at 0.25% and -0.50% respectively and indicted that will keep the pace of the bond buying programme PEPP significantly faster in this quarter. The ECB President Christine Lagarde expects the Eurozone GDP to return to pre-pandemic levels in H2 2022, possibly with some countries lagging.

![]() IHS Markit reported on Friday April 23 that the UK business activity is growing fast with the Composite Output Index for April rising to 60, the highest since 2013. Both services and manufacturing sectors are expanding thanks to the increasing demand for both goods and services and the strong growth is expected to continue in May and June when the lockdown restrictions are lifted further.

IHS Markit reported on Friday April 23 that the UK business activity is growing fast with the Composite Output Index for April rising to 60, the highest since 2013. Both services and manufacturing sectors are expanding thanks to the increasing demand for both goods and services and the strong growth is expected to continue in May and June when the lockdown restrictions are lifted further.

![]()

![]()

![]() The US Annualised GDP growth for Q1 2021 will be announced on Thursday April 29, expected at 6.5% QoQ.

The US Annualised GDP growth for Q1 2021 will be announced on Thursday April 29, expected at 6.5% QoQ.

![]() Eurozone CPI for April will be announced on Friday April 30, with an expectation of 1.6% YoY.

Eurozone CPI for April will be announced on Friday April 30, with an expectation of 1.6% YoY.

![]()

+0.71*

-1.0 A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

0.0 A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

+1.0 A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

*as at latest realignment 16/04/21

Notice:

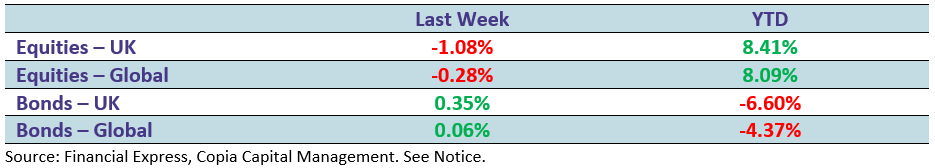

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.