![]()

![]() Stock markets extended gains last week as the optimism was boosted by the strong economic data in the US, Europe and China. The US retail sales climbed by 9.8% in March and Europe inflation rate improved to 1.3% YoY. China’s GDP growth for 1Q21 stood at a record 18.3% YoY, showing a steady post-Covid recovery.

Stock markets extended gains last week as the optimism was boosted by the strong economic data in the US, Europe and China. The US retail sales climbed by 9.8% in March and Europe inflation rate improved to 1.3% YoY. China’s GDP growth for 1Q21 stood at a record 18.3% YoY, showing a steady post-Covid recovery.

![]() On Thursday April 15, Biden signed an executive order to impose sanctions against a few Russian entities and officials, accusing them of interference in the 2020 US election and conducting cyber-espionage campaigns. Russia denied all the allegations and said that the retaliation is inevitable.

On Thursday April 15, Biden signed an executive order to impose sanctions against a few Russian entities and officials, accusing them of interference in the 2020 US election and conducting cyber-espionage campaigns. Russia denied all the allegations and said that the retaliation is inevitable.

![]() The UK started slowly relaxing the lockdown restrictions from Monday April 12, with shops reopening in England and Wales, and restaurants reopening outdoors in England. The country has seen a fast-declining Covid infections and around 50% of the population has received first vaccination.

The UK started slowly relaxing the lockdown restrictions from Monday April 12, with shops reopening in England and Wales, and restaurants reopening outdoors in England. The country has seen a fast-declining Covid infections and around 50% of the population has received first vaccination.

![]() The US Fed Chairman Jerome Powell stated on Wednesday April 14 that the US economy is still faced with coronavirus risks and a rate hike is unlikely before 2024. He also indicated that the Fed would taper asset purchases before considering raising interest rates when they see the economy making substantial progress.

The US Fed Chairman Jerome Powell stated on Wednesday April 14 that the US economy is still faced with coronavirus risks and a rate hike is unlikely before 2024. He also indicated that the Fed would taper asset purchases before considering raising interest rates when they see the economy making substantial progress.

![]()

![]()

![]() UK unemployment rate will be released on Tuesday April 20 and is expected at 5.1%.

UK unemployment rate will be released on Tuesday April 20 and is expected at 5.1%.

![]() UK CPI for March will be announced on Wednesday April 21, with an expectation of 0.8% YoY.

UK CPI for March will be announced on Wednesday April 21, with an expectation of 0.8% YoY.

![]()

+0.71*

-1.0 A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

0.0 A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

+1.0 A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

*as at latest realignment 31/03/21

Notice:

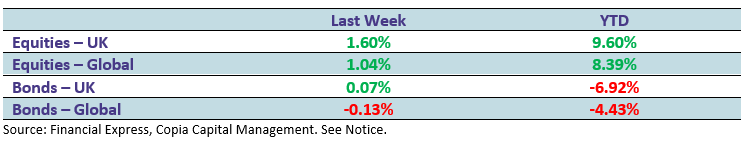

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.